Cardano is a third-generation proof-of-stake blockchain. Cardano, like ethereum, will allow developers to use the cardano blockchain for familiar features, including running custom programming logic (smart contracts) and building programs (decentralised applications). Cardano launched its smart contracts on testnet in May 2021, with a mainnet launch to follow later in the year.

However, Cardano is working on solving the scalability and energy consumption problems that the likes of bitcoin and ethereum have.

Cardano differs from the other projects by emphasising a research-driven approach to design, aiming to achieve an academic rigour it believes will propel the adoption of its technology.

For example, its consensus algorithm, Ouroboros, has been deemed “provably secure” by process of formal review. Additionally, cardano’s code was written in the Haskell programming language, commonly used in the banking and defence sectors.

How does it work?

Unlike bitcoin’s proof-of-work model, cardano uses a proof-of-stake consensus mechanism to secure its blockchain.

Proof-of-stake is a mechanism that allows for the network to act in its own best interest, and through this action, of acting in your own best interest, you inherently end up securing the network.

It does this by allowing the network to have a vested interest in the network itself, by enabling users to stake their assets on the network. This is a similar concept to having equity in a company you work for. Suddenly you have a vested interest in the company, and you really care about how it performs. You have a stake in its success, and now you’re a “stakeholder”.

Cardano’s primary use case is to allow transactions in its native cryptocurrency, ADA, and to enable developers to build secure and scalable applications powered by it.

The cardano blockchain structure

The cardano blockchain is divided into two layers:

- The cardano settlement layer: The CSL is used to transfer ADA between accounts and to record transactions.

- The cardano computation layer: The CCL contains the smart contract logic that developers can leverage to programmatically move funds.

Furthermore, computers running the cardano software can join as one of three nodes:

- mCore nodes: Stake ADA tokens and participate in blockchain governance.

- Relay nodes: Send data between mCore nodes and the public Internet.

- Edge nodes: Create cryptocurrency transactions.

Why invest in cardano?

1. Solving scalability and high fees

Cardano seeks to offer many of ethereum’s most compelling capabilities, including robust smart contracts. Meanwhile, cardano was designed to support fast transactions with minimal transaction fees thereby solving the issues ethereum is facing.

2. Reducing blockchain energy consumption

With everyone worried about the energy consumption required to secure blockchain networks, cardano has been built to be an energy-efficient blockchain since day one. This feature could play a vital role in cardano’s future success and adoption.

3. Scarcity

For all the hard-money enthusiasts out there, cardano has you covered. Unlike ethereum, Cardano has a strict cap of 45 billion coins in its total diluted supply.

4. Third-generation blockchain exposure

Cardano is the world’s largest third-generation cryptocurrency. It is therefore an ultimate asset to buy if you are looking to gain exposure to this universe.

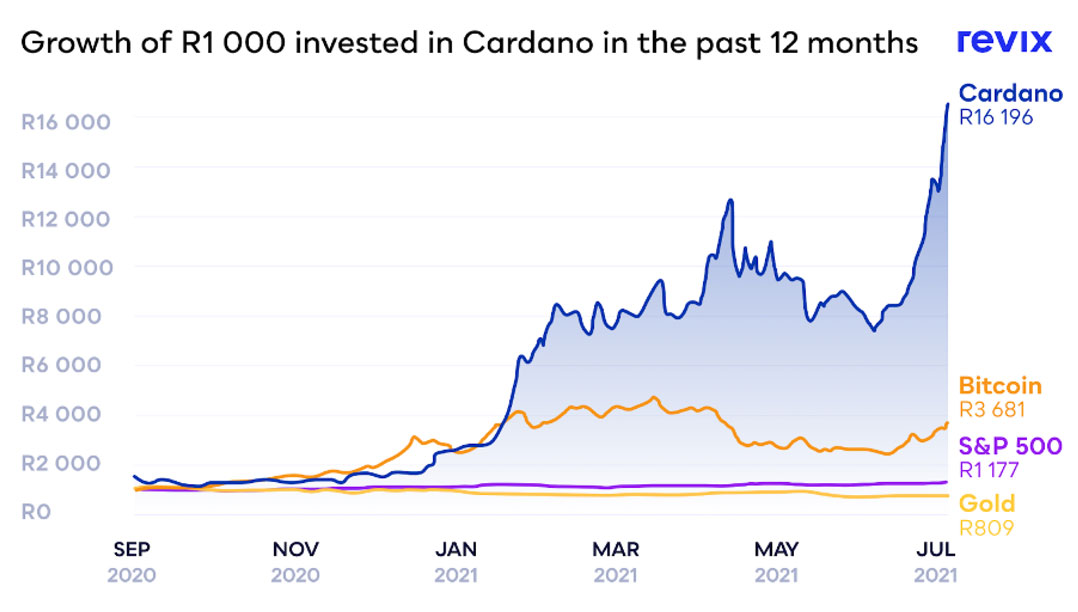

Cardano’s performance

Recently, cardano has started to show a large price appreciation, but what has this growth been driven by? There are a few factors at play:

- The overall cryptocurrency market has seen a strong recovery from the July lows.

- The growing interest in the smart contract sector.

- Most importantly was the announcement that cardano’s software update will bring the long-awaited release of smart-contract capabilities.

Below we can see how cardano has outperformed many other investment assets in the past 12 months:

Select “Read Full Article” Link below to continue reading…

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience and investment objectives and seek independent financial advice if necessary.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  TRON

TRON