– Support zones can often be difficult to identify.

– The Ichimoku Kinko Hyo system provides fantastic levels of support.

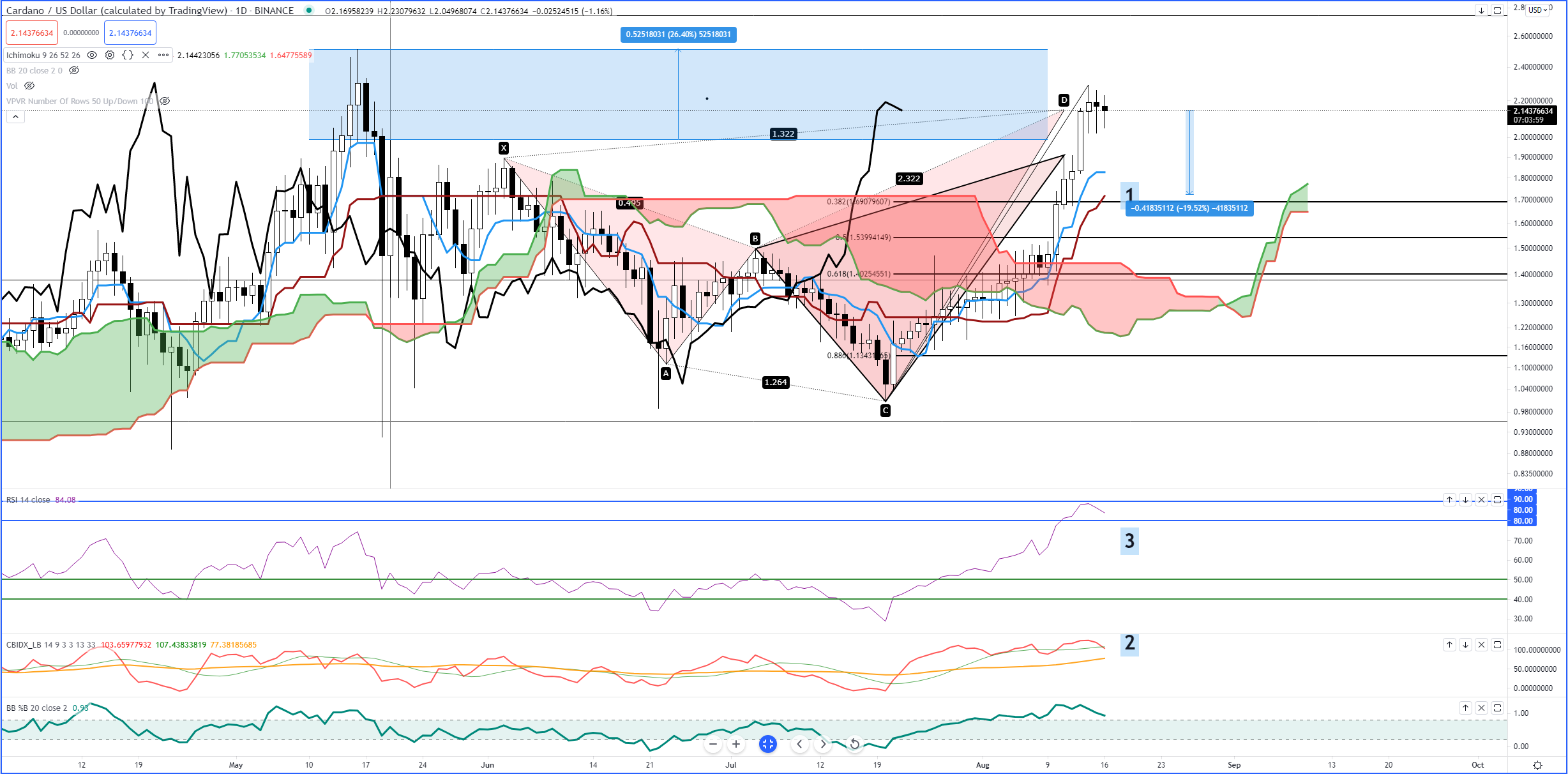

Cardano (ADA)

Above: Cardano (ADAUSD)

When I look at Cardano’s daily chart above, I notice one glaring condition: significant and consecutive gaps between the daily close and the Tenkan-Sen (#1). It is rare for price to not correct back to the Tenkan-Sen when a significant gap occurs. The RSI (#3) is setup with the overbought and oversold levels used in a bull market. The final overbought level is 90 and Cardano was just recently trading near that range this past weekend. The RSI is currently sloping lower. The sign that I see an imminent pullback occurring is not just the slope of the RSI, but what is happening on the Composite Index (#2). The Composite Index has crossed below its fast average (green moving average). Because I expect the gap between the daily close and the Tenkan-Sen to fill, the support zone I would expect it to find is between the daily Tenkan-Sen and Kijun-Sen (1.82 and 1.71, respectively). The ideal condition I would like to see if Cardano moves down to either of those levels is for the Composite Index to form a lower trough, thereby creating hidden bullish divergence and helping confirm support at/near the Tenkan-Sen and Kijun-Sen. For dip buyers, a move to either the Tenkan-Sen or Kijun-Sen as support would represent a 15% to 20% discount from the present trading value.

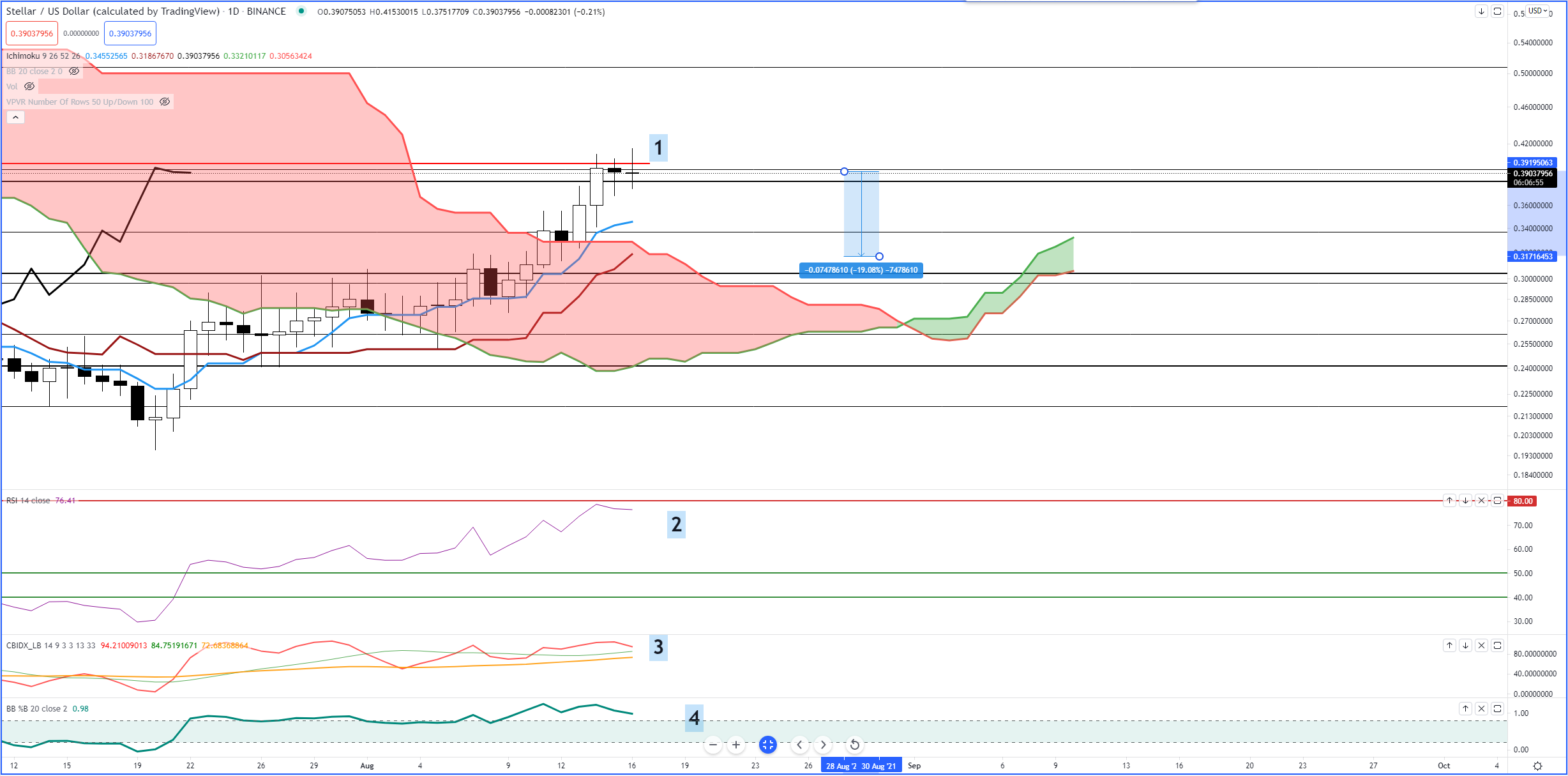

Stellar (XLM)

Above: Stellar (XLMUSD)

Advertisement

Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year 2016 – 2020. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone.

Find out more here.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc