[ad_1]

Men’s Journal aims to feature only the best products and services. We update when possible, but deals expire and prices can change. If you buy something via one of our links, we may earn a commission.

Questions? Reach us at shop@mensjournal.com.

Cryptocurrency is not necessarily new, but it’s far from a mature industry. In fact, many would say that cryptocurrency and block-chain technology in general, are still well in their infancy. As such, there are still many potential discoveries to make in the world of cryptocurrency and blockchain technology while learning how to integrate it into our everyday lives. Despite the popular belief that Bitcoin was the first cryptocurrency to hit the market, the first cryptocurrency came about in the 1990s. The first ever developed cryptocurrency was eCash, created by David Chaum and his company Digicash. After eCash, several other forms of cryptocurrency arose, including E-Gold, Bit Gold, B-Money, and Hashcash. However, it wasn’t until 2008, nearly two decades after eCash hit the scene, that Bitcoin was finally released in a whitepaper.

It’s noteworthy that these preceding cryptocurrencies laid the groundwork and foundation for the success of modern day cryptocurrencies as they exist. For example, elements of B-Money specifically were referenced by Nakamoto in the Bitcoin whitepaper that was published in 2008.

While cryptocurrency and other variations of blockchain technology have been around for a while, their mainstream role in the public eye is relatively new, which is why many consumers are still unsure of exactly how Bitcoin, Ethereum, and other popular cryptocurrencies actually work.

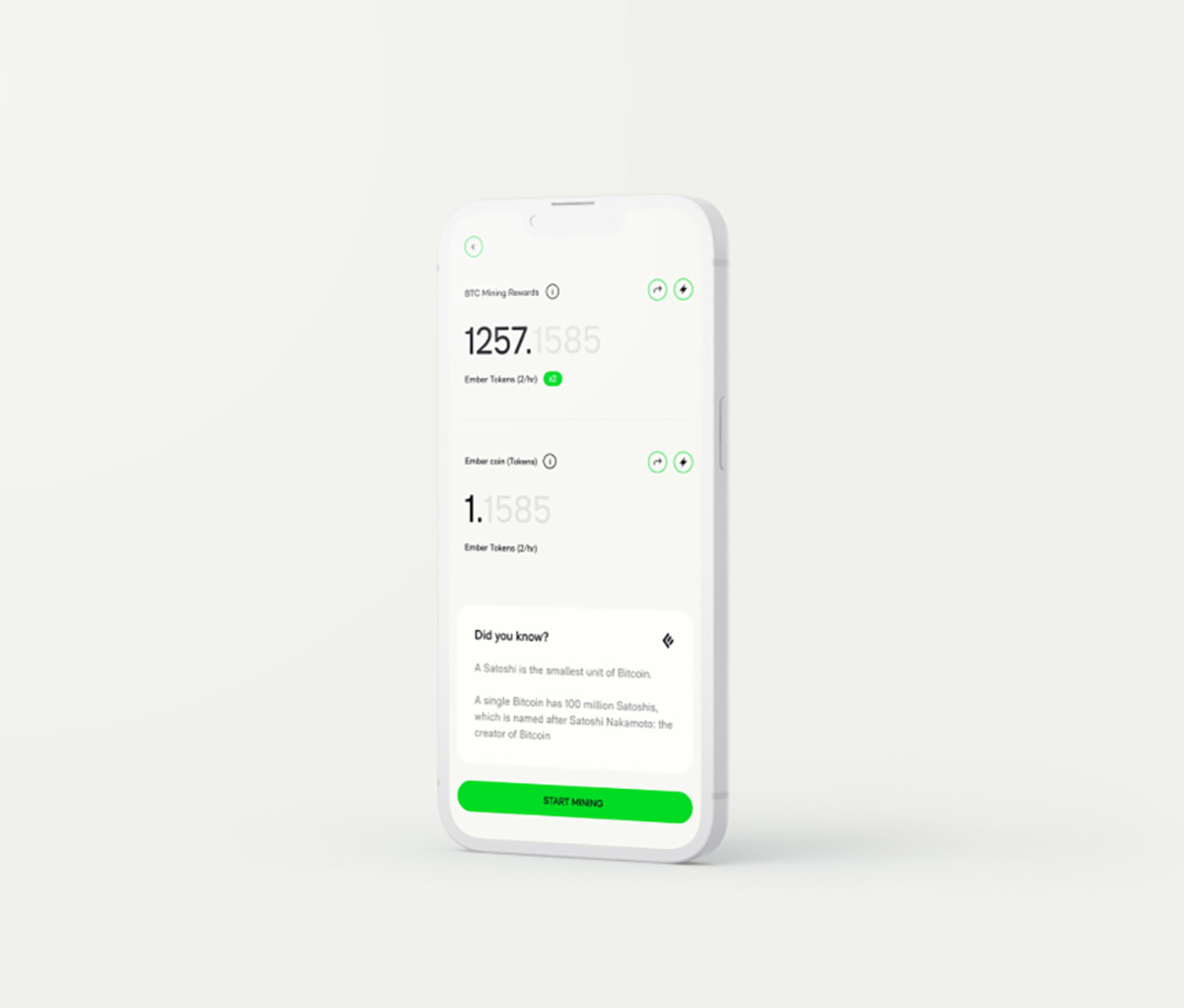

This makes finding and understanding the ins and outs of cryptocurrency investing a bit like navigating a maze and can turn plenty of consumers off from the overall product. It is this very line of thinking that inspired the creation of Ember Fund, a cryptocurrency investment platform that takes a lot of the guess-work out of building cryptocurrency investment portfolios while making them accessible to the public.

How Ember Fund Stands Out

Ember Fund is different from your average crypto-investment platform. When you invest on the Ember Fund App, your transaction is verifiable on-chain via Etherscan or Blockchain Explorer and only you can access your assets with your keys. Contrast this with centralized exchanges such as Robinhood or Coinbase, which have been criticized for halting trading and potentially taking control over user funds in certain scenarios.

The goal of Ember Fund is to help everyday people invest smarter by crafting thematic indexes and leaving the coin selection to the experts. These portfolios automatically rebalance at no extra cost and are tax-free events. Given the volatility of crypto, rebalancing regularly is critical to generate optimized returns. Imagine having to buy and sell 15 cryptocurrencies to rebalance every month and pay transaction fees on those rebalancing trades.

Crypto Investing Basics

Cryptocurrency investing should be viewed in a very similar manner to equities investing. At the end of the day, good investing practices include due diligence on the management team, assessing liquidity levels and understanding counterparty risk. In addition, proper diversification of uncorrelated assets ensures that losses are minimized and gains are maximized during various cycles of the market. In that same vein, think of cryptocurrency as just one more asset class in your comprehensive investment portfolio.

Another important element to keep in mind is that cryptocurrencies are known for their volatility.. As such, a savvy crypto-investor will want to watch their portfolio closely so that they know when to sell and when to purchase additional assets. However, it is extremely difficult to time the market so for someone who is new to crypto-investing, Ember Fund eases this initial confusion by offering expert-crafted custom crypto portfolios that are auto-rebalanced periodically.

Choosing Your Ember Fund Portfolio

There are a variety of crypto-currency investment portfolios to choose from when working with Ember Fund. Each of these Ethereum-based investment portfolios are individually crafted and designed to offer broad exposure to a specific theme.

Not only that, but the different and unique cryptocurrency portfolios offered by Ember Fund make use of a variety of investment strategies and tactics to help consumers find success investing in the web3 space.

Getting to know the ins and outs of the various portfolios offered by Ember Fund can help a consumer choose the investment portfolio that feels suitable for them and their investment goals.

The Originals

The first portfolio that Ember Fund offers consumers in their suite of investment products is titled “The Originals.” This is an investment fund that automatically rebalances between Ethereum and Bitcoin on a quarterly basis.

This balancing act is an effective strategy because Bitcoin and Ethereum represent two of the largest cryptocurrencies by market cap. These two cryptocurrency giants account for nearly a 65% market share, a truly dominant holding.

Breaking down that market share even further, Bitcoin, the largest cryptocurrency and respected store of value, alone accounts for over 44% of the cryptocurrency market. The Originals portfolio is the ideal way to invest in the highest quality cryptocurrencies with built in fee-free auto-rebalancing.

Bitcoin Defense

Bitcoin Defense is another investment portfolio offered by Ember Fund. This fund operates a bit uniquely compared to the other Ember Fund’s other portfolios. Specifically, the Bitcoin Defense fund algorithmically trades between Bitcoin and USDC or the USD Coin.

This type of trading is specifically designed to offer downside protection to investors and has performed well to-date. During the bear market in 2018, bitcoin was down 73% while Bitcoin Defense was up 3%. If you want to invest in Bitcoin but want to trade it conservatively, the Bitcoin Defense portfolio could be the perfect place for you to get your feet wet.

The Metaverse Index

Next on the list of portfolios to consider is the Metaverse Index. For investors who believe that the advancement of virtual reality technology will drive mass adoption of play-to-earn gaming, real estate, e-commerce and entertainment, the Metaverse is a great way to get broad exposure across 18 metaverse assets.

Included in this portfolio are: Decentraland, Sandbox, Axie Infinity, Enjin, Illuvium, Merit Circle, Waxe, Audius, Yield Guild Games, Yallt, Looks Rare, Decentral Games, Eternity Chain Token, Terra Virtua Kolect, Rarible, Nftx Token, Whale, and Revv Token.

The DeFi Index

The DeFi index is also a compilation of the largest DeFi projects weighted by market cap. This portfolio includes exchanges, DAOs, peer-to-peer lending platforms, and stablecoins, including: Uniswap, Aave, Maker DAO, Synthetix, USD Coin, Loopring, Tribe, Compound, Yearn Finance, SushiToken, Kyber Network, Republic, Balancer, Badger DAO, and Harvest Finance. The decentralized finance market grew by over 100x from 2019-2022. This index is automatically rebalanced, tax-free at no additional cost.

The NFT Index

Finally, Ember Fund aims to increase access to the best web3 investing opportunities by fractionalizing premier digital assets that cost hundreds of thousands of dollars and allow everyday investors to invest in these assets with just $10. As such, their TOP NFT Index includes fractionalized shares of Bored Ape Yacht Club, CryptoPunks, Doodles, and World of Women, some of the most expensive and prominent NFTs on the market.

Taking Control of Your Crypto Investment Strategy

Ember Fund was founded in 2018 by a group of technology professionals who could see the potential of blockchain technology and cryptocurrencies being misused.

Now, nearly five years later, the team is helping countless consumers navigate the world of cryptocurrency with a little help from expert guides to truly bring the power of cryptocurrency to the fingertips of everyday consumers.

A Few Last Words on Ember Fund

While the world of cryptocurrency, NFTs, and other blockchain technologies may seem overwhelmingly complicated, they also offer undeniable potential. Ember Fund is dedicated to cutting out the complexities involved in cryptocurrency trading to make it a much more accessible asset class for everyone.

If you’re interested in learning more about cryptocurrency in general or would like to explore some of the options offered by Ember Fund in more depth, you can download the Ember Fund app right here and get your web3 investing journey today.

[ad_2]

Source link