- Dogecoin price faces significant selling pressure in the short-term.

- A key indicator has presented a strong sell signal on the 12-hour chart.

- DOGE bulls must defend a key support level to avoid a significant fall.

Dogecoin has been trading in a short-term downtrend, despite Mark Cuban’s positive comments in the past two days. The digital asset is at risk of a significant drop if it can’t stay above a critical support level.

Dogecoin price at risk of a significant correction

On the 12-hour chart, the TD Sequential indicator has just presented a sell signal. If Dogecoin price can’t hold the $0.054 support level at the 61.8% Fibonacci level, DOGE will likely fall towards $0.052 and as low as $0.049 at the 38.2% Fib level.

DOGE/USD 12-hour chart

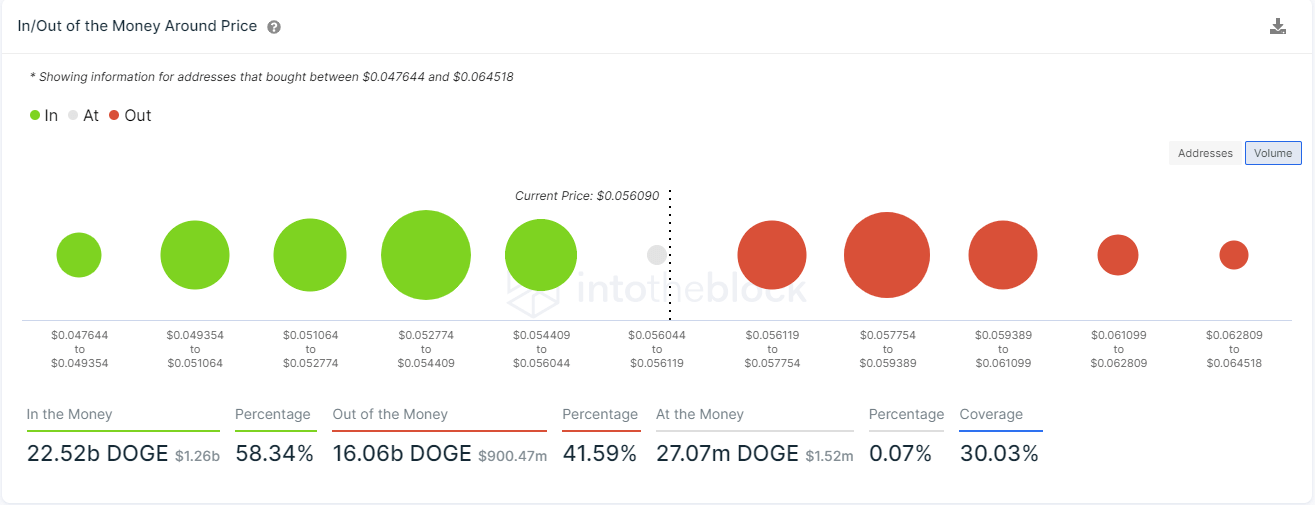

The In/Out of the Money Around Price (IOMAP) model shows that the area between $0.053 and $0.054 is the most significant support range. A breakdown below this point will push Dogecoin price down to $0.049, the same price target given by the Fibonacci Retracement indicator, adding credence to this theory.

DOGE IOMAP chart

To invalidate the sell signal, Dogecoin must climb above the last high of $0.0587 and see a 12-hour candlestick close there. The next resistance point is located at $0.063.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  TRON

TRON