- Dogecoin price hints at a 75% upswing as the bull flag pattern develops.

- A decisive close above $0.058 would indicate a start of a bullish breakout.

- Mounting selling pressure could invalidate crucial support at $0.047 and push it down by 20% to $0.037.

Dogecoin price shows resilience even as a market-wide sell-off pushed many altcoins below crucial levels.

Despite the bearish nature of the market, DOGE sits inside a bull flag pattern, suggesting a possibility of a 75% surge.

Dogecoin price needs to overcome multiple sell-signals

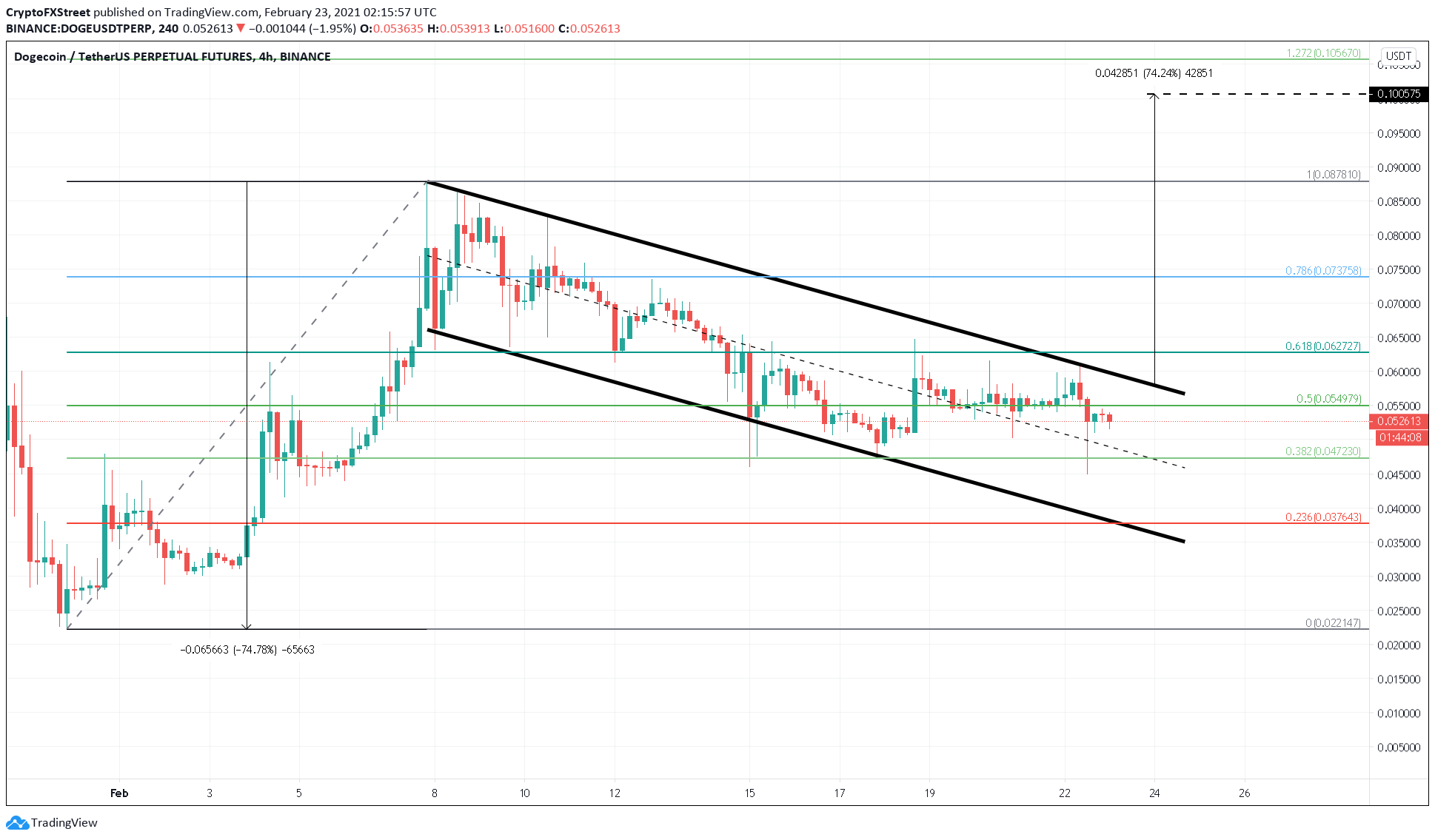

Dogecoin price action from January 30 to-date has resulted in a continuation pattern known as “bull flag.” The 300% surge between January 30 and February 7 resulted in the “flag pole,” while a series of lower highs and lower lows that followed it formed the “flag.”

The technical formation predicts a 75% bull rally determined by measuring the flag pole’s length and adding it to the breakout point at $0.058.

This target puts DOGE at $0.1.

For a successful breakout, DOGE needs to move past an immediate resistance level at $0.055, which coincides with the 50% Fibonacci retracement level.

However, only a four-hour candlestick close above $0.058 would confirm a bullish breakout.

DOGE/USDT 4-hour chart

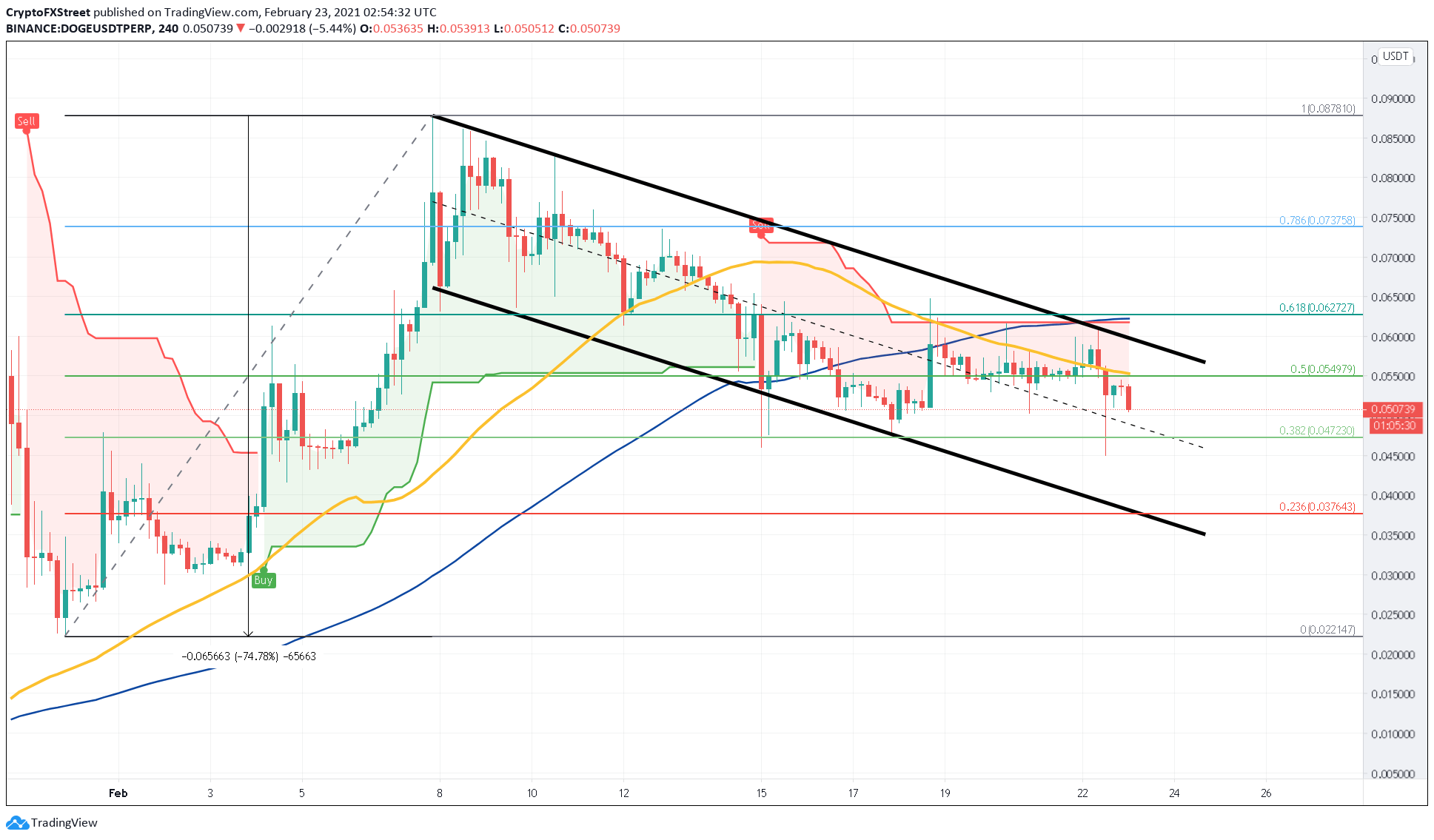

Dogecoin is facing mounting sell pressure from multiple technical indicators.

The SuperTrend indicator’s sell-signal has rejected DOGE’s bullish spikes thrice in the last five days.

Additionally, the 50 four-hour moving average (MA) and the 100 four-hour MA have moved above the price. This development might threaten any future short-term buying momentum.

DOGE/USDT 4-hour chart

Therefore, if Dogecoin price slices below the initial support at $0.047 or the 38.2% Fibonacci retracement level, it could trigger a 20% sell-off. This drop puts DOGE at $0.037, which coincides with the 23.6% Fibonacci retracement level.

Depending on the market conditions, DOGE might give the bull flag pattern another try from $0.037.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin