Qubic says it is now building a Dogecoin mining integration, a step that moves the project’s post-Monero “attention” narrative into an implementation phase and reopens a familiar set of security questions around majority-hashrate risk.

In an X post shared Thursday, Qubic wrote: “The community didn’t hesitate. The vote was decisive: DOGE won with 301 votes. This isn’t a plug-and-play upgrade. Integrating ASIC hardware into uPoW requires real engineering, deep protocol work, and time to do it right. But the upside is significant. DOGE represents one of the largest and most established mining economies in crypto. Bringing it into Qubic’s useful Proof-of-Work model extends uPoW beyond theory, into scale. […] Development is underway. This is just the beginning of what is to come.”

Dogecoin mining integration is actively in development.

The community didn’t hesitate.

The vote was decisive: #DOGE won with 301 votes.This isn’t a plug-and-play upgrade.

Integrating ASIC hardware into uPoW requires real engineering, deep protocol work, and time to do it… pic.twitter.com/7aBgxfLdDR

— Qubic (@_Qubic_) January 22, 2026

Could Dogecoin Suffer A 51% Attack?

The announcement lands with baggage. In August 2025, Qubic ran what it publicly described as a Monero “takeover demonstration,” claiming it had achieved “over 51% hashrate dominance” during parts of the experiment and reporting a brief chain disruption that included a six-block reorganization and orphaned blocks.

That episode became a lightning rod for the broader PoW security debate: how quickly external incentives can concentrate hashpower, and how markets react when “51%” enters the conversation.

Subsequent research challenged the strongest interpretation of those claims. A December 2025 paper reconstructing Qubic-attributed activity on Monero describes the operation as an advertised “selfish mining campaign,” finding Qubic’s hashrate share rising into the 23–34% range in detected intervals, while “sustained 51% control is never observed.”

Dogecoin’s mining economy is structurally unlike Monero’s CPU-oriented RandomX landscape. Dogecoin uses Scrypt and has, since 2014, supported merged mining alongside Litecoin, an architecture that has historically helped bolster its security budget by tapping into a broader Scrypt ASIC miner base.

That hardware reality is central to Qubic’s own messaging. The project said “integrating ASIC hardware into uPoW requires real engineering, deep protocol work, and time to do it right,” explicitly acknowledging that this is not a simple pool launch.

It is also where most of the immediate 51% attack fears run into friction. In an August 2025 research note, published when Qubic first began floating Dogecoin as the “next” network after Monero, 21Shares argued that a brute-force Dogecoin majority would be economically prohibitive, estimating that Qubic would need to match and then exceed roughly 2.78 PH/s, implying about $2.85 billion in hardware plus roughly $2.5 million per day in electricity (before logistics).

The more plausible risk vector, if any, is not Qubic buying its way to majority hashrate, but whether it can engineer incentives and integrations that convince existing Scrypt ASIC operators to route meaningful hashpower through a Qubic-mediated setup, an approach 21Shares characterized as “vampire mining.”

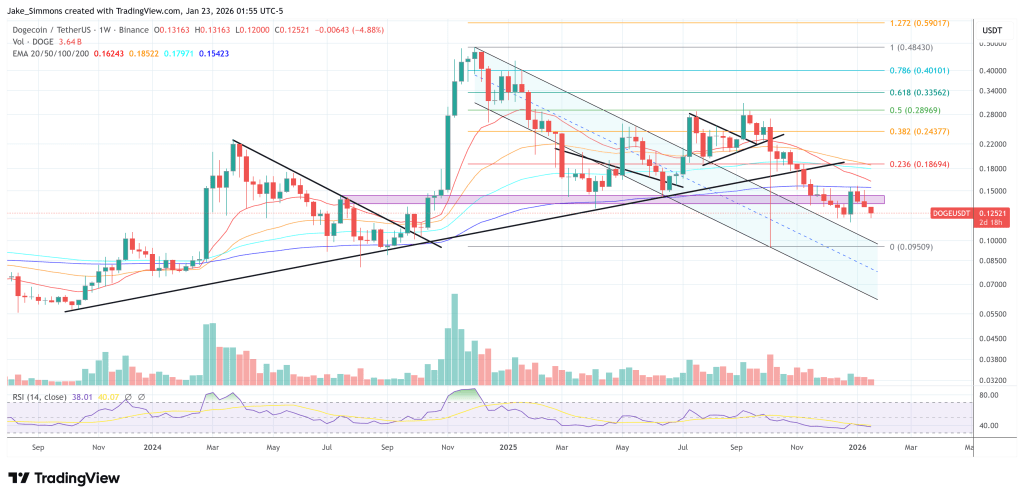

At press time, DOGE traded at $0.12521.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether