A recent CryptoQuant analysis reveals that up to 40% of the Bitcoin portfolio of Michael Saylor’s Strategy is now seeing losses.

Bitcoin (BTC) has been on a downward slope over the past week, posting intraday losses in six of the last seven days, and is on track to record a seventh loss over eight days. Within this period, Bitcoin has dropped nearly 14%, losing the $100,000 and $95,000 support levels to trade at $91,367 at press time.

Saylor Remains Unfazed by Recent Bitcoin Downtrend

Despite the downtrend, Michael Saylor’s Strategy (formerly MicroStrategy) remains unfazed, instead regarding the dip as an opportunity to procure more BTC. In the latest instance, Saylor disclosed on Monday that Strategy had bought an additional 8,178 BTC tokens for $835.6 million at a price of $102,171 per BTC.

Strategy has acquired 8,178 BTC for ~$835.6 million at ~$102,171 per bitcoin and has achieved BTC Yield of 27.8% YTD 2025. As of 11/16/2025, we hodl 649,870 $BTC acquired for ~$48.37 billion at ~$74,433 per bitcoin. $MSTR $STRC $STRD $STRE $STRF $STRK https://t.co/HI1TeYOvQ9

— Michael Saylor (@saylor) November 17, 2025

Notably, with this purchase, the company confirmed that it now holds 649,870 BTC, representing 3.2% of the circulating Bitcoin supply, which it procured for $48.37 billion. With BTC now trading for $91,367 per token, Strategy’s holdings have a worth of $59.38 billion. This represents an overall profit of 22.7%.

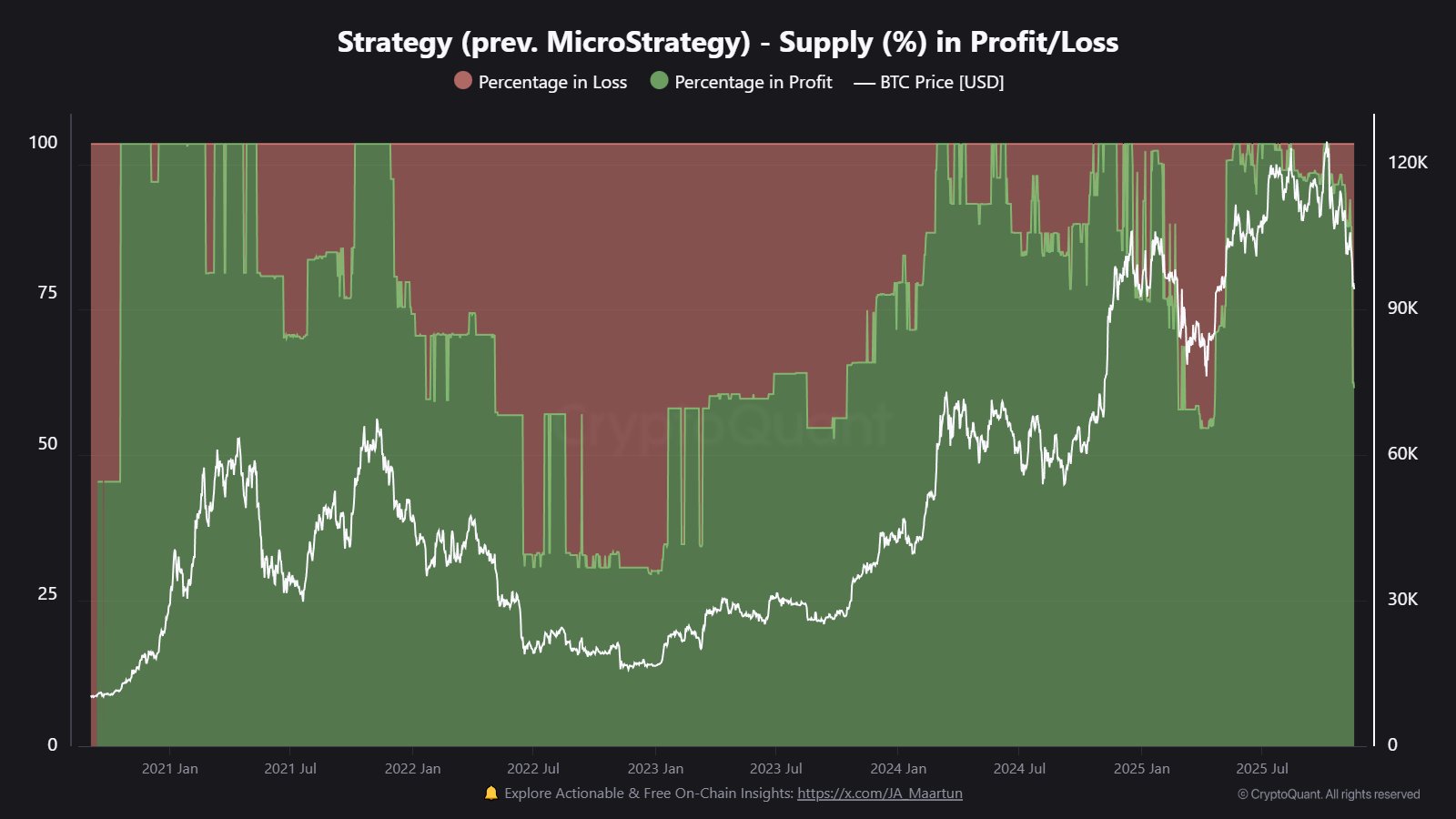

40% of Strategy’s Bitcoin Portfolio in Loss

However, a recent CryptoQuant analysis suggests that, in an analytical breakdown of the Strategy holdings, 40% of the portfolio is now seeing losses. According to CryptoQuant, these losses are a result of the recent purchases Strategy made, which have reduced the portfolio’s overall profit ratio.

Specifically, for the latest 8,178 BTC purchase, Strategy has lost $88 million within a few days, with the investment now down 10.5%.

Interestingly, the latest buy is one of three purchases Strategy has made this month despite the ongoing market downturn. Notably, on Nov. 3, Saylor confirmed that Strategy bought 397 BTC for $45.6 million. Moreover, a disclosure on Nov. 10 revealed that the company also amassed 487 BTC for $49.9 million.

Together, Strategy has bought 9,062 BTC for $931.1 million in November. At current rates, these tokens are worth $827.96 million, representing a loss of over 11%. This has contributed to the losses suffered by 40% of the company’s Bitcoin holdings.

Strategy Remains in a Strong Position

However, with an overall profit ratio of 22.7% and a paper gain of $11.46 billion, Strategy remains in a strong position despite the poor performance of the latest purchases.

The company has seen worse days, especially from mid-2022 to early 2023, when up to 75% of its holdings were in loss. During this period, Strategy’s Bitcoin holdings suffered an overall performance of -33.4%, with losses of around $1.32 billion. In late October 2024, the overall performance went positive and has remained so since then.

Nonetheless, the latest profit ratio of 22.7% is a massive drop from the peak of 68.6% early last month, when Strategy saw gains of $32.47 billion. Following Saylor’s latest disclosure, gold advocate Peter Schiff voiced his usual criticisms, arguing that Strategy’s average price of $74,433 and Bitcoin’s market price are slowly converging.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin