CryptoQuant founder reveals that Bitcoin whale investors have been steadily taking profits since BTC clocked $100,000, noting heavy selling pressure.

The Bitcoin price rose above $107,400 on Tuesday, fueled by hopes of the U.S. government shutdown resolution. However, it has dropped nearly 2% in the past 24 hours to $103,400 at the time of writing. Accordingly, several market watchers have called attention to the rising selloffs from different whales.

Bitcoin Whales Are Dumping

According to Ki Young Ju, founder of blockchain analytics platform CryptoQuant, Bitcoin whale investors have been cashing out billions of dollars ever since BTC touched $100,000.

While Ju did not provide on-chain data to support his claim, crypto founder Charles Edwards confirmed record sales of BTC by whales in an analysis on November 7.

Citing data from Glassnode, Edwards highlighted seven-plus years of on-chain spending by pre-2018 BTC holders. The data shows multiple sell-offs exceeding $100 million and $500 million in 2025 alone, occurring after BTC reached $100,000.

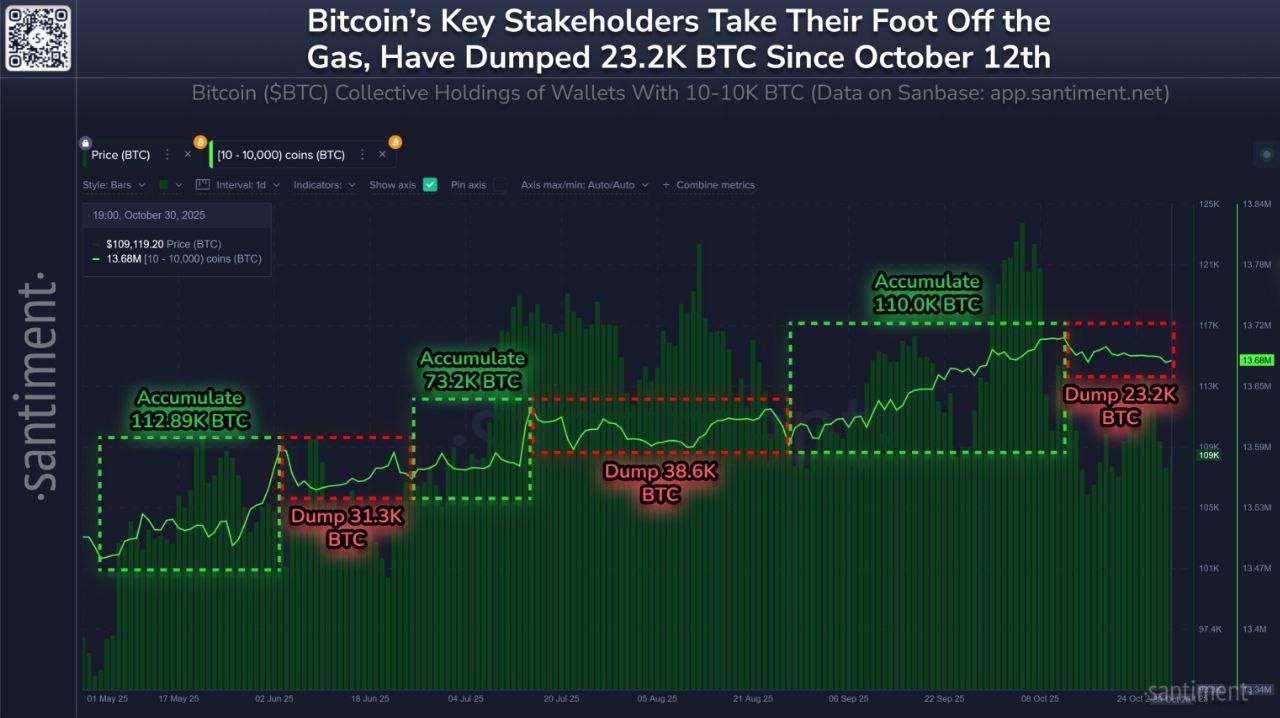

Similarly, Santiment data indicates that wallets holding between 10 and 10,000 BTC have collectively offloaded over 23,200 BTC worth over $2 billion since October 12.

Adding to the selling pressure, a long-standing Bitcoin wallet reportedly sold 11,000 BTC on November 12 after holding the coins for 15 years, according to a Wednesday update on X from TwoCryptoBros.

Will Sellers Dominate?

In his post, Ju reiterated his view that the bull cycle ended in early 2025, suggesting a bear market was likely to follow. However, he acknowledged that heavy BTC accumulations from institutional investors like Strategy (formerly MicroStrategy) and notable inflows into BTC exchange-traded funds (ETFs) offset the bearish outlook.

Nonetheless, Ju has predicted that sellers will dominate the crypto market again if institutional capital and ETF inflows fade. He further highlighted in the post that there is still heavy selling pressure in the market as BTC failed to break the $108,000 resistance in its latest upswing.

However, Ju said the current levels of BTC could be a good accumulation opportunity for those investors who think the BTC’s macro outlook is strong.

Why Current Entry May Be Favorable

As earlier highlighted by CryptoQuant analyst Moreno, Bitcoin’s current level is at a liquidity setup that has historically set the tone for major BTC rallies. This further signals a good buying opportunity for Bitcoin investors.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin