Notable Ichimoku Cloud analyst Dr. Pastet recently suggested that XRP may outperform Ethereum (ETH) during the current crypto bull cycle.

His analysis focused on the XRP/ETH, XRP/BTC, and ETH/BTC pairings. Dr. Pastet’s primary tool, the Ichimoku Cloud, helps highlight trend direction and price momentum.

The commentary suggests a difference in the positions of XRP and ETH this cycle. Pastet noted that critical elements in the Ichimoku Cloud, such as the Kijun-sen and Chikou Span, signal stronger prospects for XRP compared to Ethereum.

For the uninitiated, the Kijun-sen is the baseline, with prices above it showing an uptrend and below it indicating a downtrend. Meanwhile, the Chikou Span (lagging span) suggests bullish momentum when it is above the asset’s price but bearish momentum when it is below.

XRP/ETH Showing Uptrend Potential

In his analysis, Dr. Pastet examined the XRP/ETH chart through the Ichimoku Cloud. He noted that XRP is trading within a range, with the Chikou Span and Kijun levels indicating potential stability.

A flat Kijun line suggests that the price will oscillate within this range, using Kijun as a central pivot point. The analyst estimates a conservative upside of around 25% from current levels, even if XRP simply touches the Kijun level.

However, if it begins oscillating more dynamically, he projects a test of the $0.93 highs from July 2023. Such a scenario could potentially lead to a price movement close to doubling XRP’s current value, contrasting Ethereum’s trajectory.

XRP/BTC and ETH/BTC are Favorable for XRP

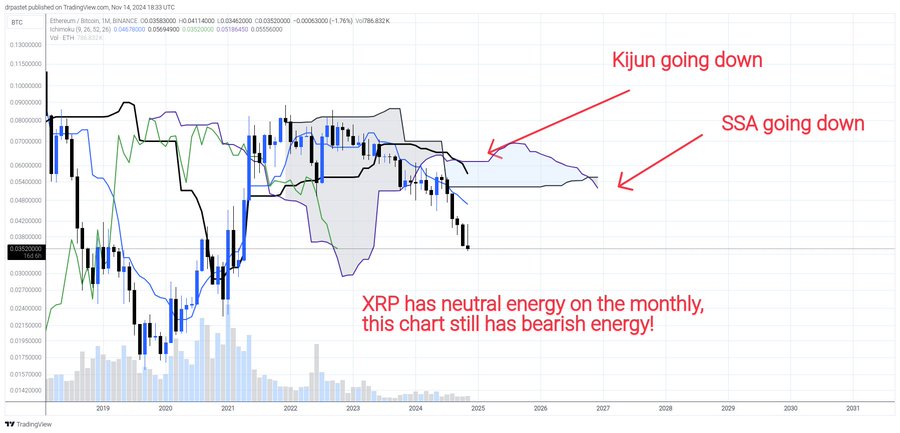

Besides the XRP/ETH pairing, Dr. Pastet spotlighted the XRP/BTC and ETH/BTC charts. He pointed out that ETH/BTC shows weakness, especially as Ethereum’s Kijun is trending downward, suggesting bearishness.

This descending Kijun implies a loss of momentum for ETH and raises the risk of a “dead cat bounce.” This is a temporary recovery in a downtrend that doesn’t indicate a reversal. Dr. Pastet expressed skepticism about Ethereum’s ability to stage a sustainable rally and believes that any bounce may quickly encounter resistance.

In contrast, XRP/BTC looks more favorable, with a flat Kijun level and Senkou Span B (SSB), which implies stability and range-bound movement.

The flat Kijun and SSB indicate XRP’s strength against Bitcoin, setting a minimum target of 0.000018 BTC for XRP. For context, XRP currently trades for 0.00000913 BTC, requiring a 97% increase to reach the 0.000018 BTC target.

XRP and Ethereum Sentiments

Besides the technical viewpoint, Dr. Pastet also discussed market sentiments around Ethereum and XRP. He argues that Ethereum enjoys strong attention from investors who expect it to bottom and then rally, assuming it remains the dominant altcoin.

According to Dr. Pastet, this widespread optimism around ETH may ultimately work against it, as markets often defy popular expectations.

In contrast, XRP has faced dismissals and even dislikes from parts of the crypto community due to its legal battle and price stagnation. Dr. Pastet believes this skepticism could lead to a surprising shift in price action.

Notably, when underappreciated crypto assets like XRP gain traction, they often outperform more hyped assets, creating unexpected gains for those who invest early.

Interestingly, XRP has continued to outperform Ethereum over the past few days. XRP had lagged at the start of the ongoing bull phase on Nov. 6 but recently picked up. As a result, XRP has gained 43% against Ethereum since Nov. 12, now trading at a three-month peak of 0.0002636 ETH.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc