According to a CryptoQuant analysis, Bitcoin has entered its most bearish phase since the current bull market began two years ago.

For context, Bitcoin (BTC) continues to slide, pulling the broader crypto market down with it. After reaching a high above $126,000 on Oct. 6, the crypto firstborn has now dropped more than 28%, erasing roughly $710 billion in market value, as it trades near $90,197.

Bitcoin In Its Most Bearish Phase Since January 2023

Amid the downtrend, CryptoQuant, in its latest weekly update, reported that Bitcoin now sits in its most bearish conditions since the bull cycle began in January 2023.

The firm noted that this pullback looks different from earlier corrections in the cycle. Notably, it pointed out that its Bull Score Index fell to a deeply bearish reading of 20 out of 100 last week due to weaker spot demand, negative price momentum, and a slowdown in stablecoin liquidity.

In addition to this, CryptoQuant confirmed a major technical change. Specifically, Bitcoin recently moved below its 365-day moving average, a level that marked the confirmation of the 2022 bear market.

The firm emphasized that Bitcoin had stayed above this trendline during every other correction in the current bull run, which makes the recent breakdown especially important.

As a result, CryptoQuant believes the market has entered a clearly bearish phase. This comes a few days after the CryptoQuant CEO, Ki Young Ju, suggested that Bitcoin had still not entered a bear market.

Demand From Treasuries and ETFs Weakening

The company also spotlighted the demand side, explaining that Treasury companies no longer support prices the way they did earlier in the year. Their market values have fallen by 70% to more than 90% in recent months, which prevents them from selling new shares to raise capital for additional Bitcoin purchases.

Moreover, despite purchasing 8,178 BTC earlier this week, CryptoQuant highlighted that Michael Saylor’s Strategy has also reduced its own buying because its stock market cap has dropped toward the value of its Bitcoin holdings.

The firm also reviewed ETF activity, stressing that ETF inflows can slow or even reverse. Notably, some institutions buy spot Bitcoin through ETFs while shorting futures to capture the spread. When that spread tightens, they unwind the trade and sell spot Bitcoin. For perspective, Bitcoin ETFs have seen outflows worth $2.89 billion this month.

Will the Current Bitcoin Cycle Stretch to 2026?

The report then called attention to the idea of Bitcoin’s four-year cycle. For context, previous cycles spanned 2014 to 2017 and 2018 to 2021, so many expected the current one to end in 2025.

CryptoQuant noted that this pattern originally came from the halving’s supply shock, but that effect has weakened as more tradable Bitcoin enters the market.

Some analysts now expect the cycle to stretch into 2026, arguing that institutional investors, rather than retail traders, now drive most of the demand. Still, CryptoQuant warns that institutional demand can disappear just as quickly, as shown by the sudden pullback among Treasury companies.

Bullish Catalysts Already Priced in

CryptoQuant argued that Bitcoin’s cycle depends on demand surges rather than halvings or calendar patterns. It believes the current demand wave has largely played out.

In 2024, Donald Trump’s election win pushed Bitcoin above $100,000 for the first time. In 2025, the rise of several Bitcoin Treasury companies lifted the price above $120,000 during the summer.

CryptoQuant noted that these catalysts have already run their course, and potential new triggers either look unlikely or appear mostly priced in.

However, the report admitted that this situation does not guarantee a sharp crash. Specifically, Bitcoin has fallen 28% and now trades near strong support between $90,000 and $92,000.

The firm pointed out that even during bear markets, Bitcoin often rallies 40% to 50% within a few months. Still, because the price now sits below the 365-day moving average, CryptoQuant expects the level near $102,600 to act as heavy resistance.

Is a Bitcoin Reversal Possible Now?

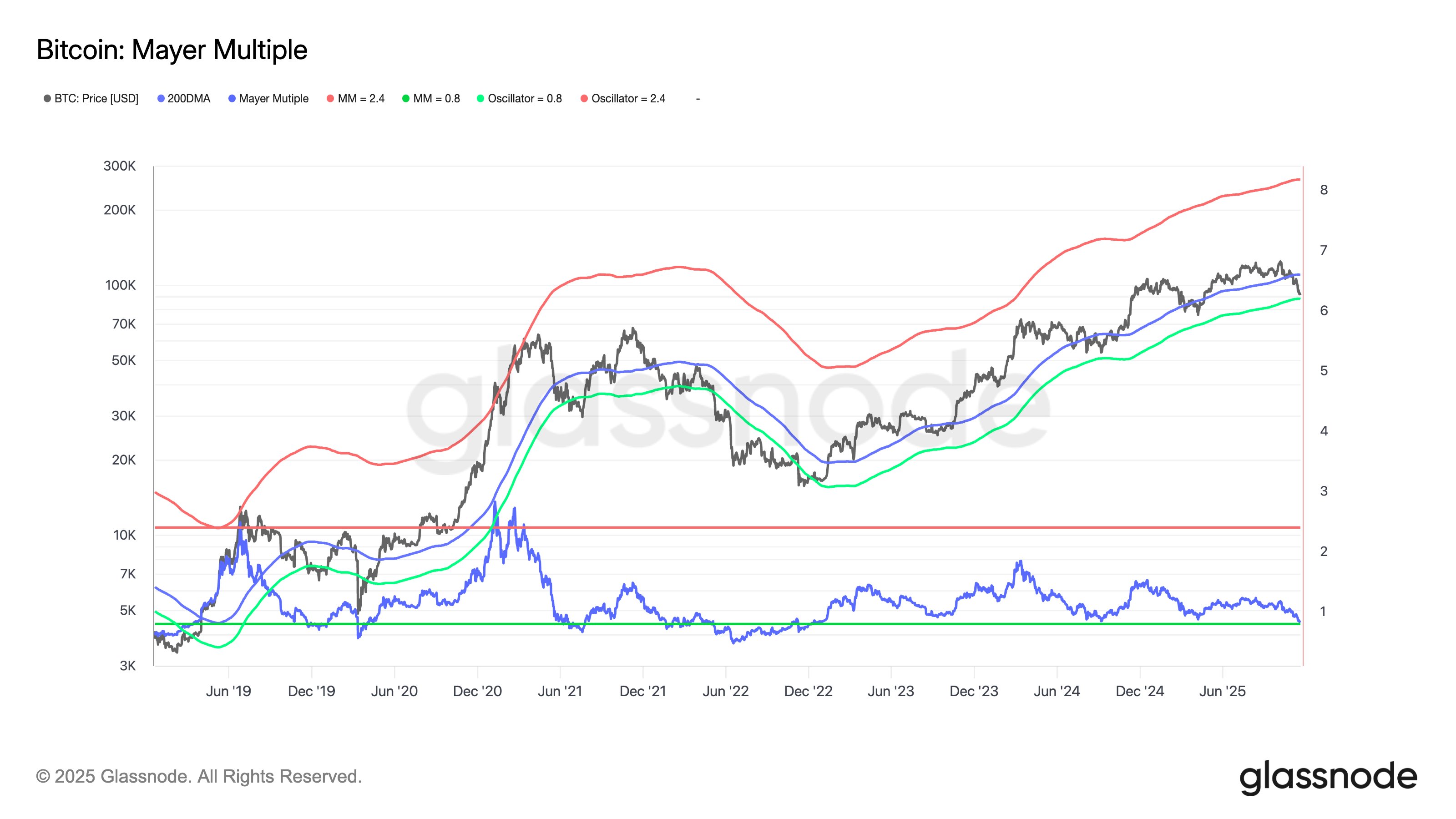

Meanwhile, in a separate disclosure, Glassnode noted that Bitcoin’s Mayer Multiple has dropped toward the lower end of its long-term range. The firm said this shift indicates slowing momentum and the early stages of a value-driven phase where buyers tend to re-enter.

Also, analyst Cas Abbé expects a short-term rebound because daily and weekly RSI readings now show oversold conditions, and most panic sellers have likely exited. Abbé believes this setup could allow Bitcoin to push back above $100,000 soon.

$BTC short-term bounce looks highly likely to happen.

Daily and weekly RSI is oversold, and most of the panic selling has happened.

It seems like Bitcoin could rally above the $100,000 level from here. pic.twitter.com/02rlEfhbny

— Cas Abbé (@cas_abbe) November 20, 2025

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin