A recent analysis has highlighted the cruciality of the current Bitcoin price level and how its next move would shape the ongoing bull market cycle.

Bitcoin (BTC) is slowly becoming unprofitable for investors who purchased the asset at the start of the year. The premier asset has declined from its all-time high of $126,200 in October, reducing its year-to-date growth to 9.72%.

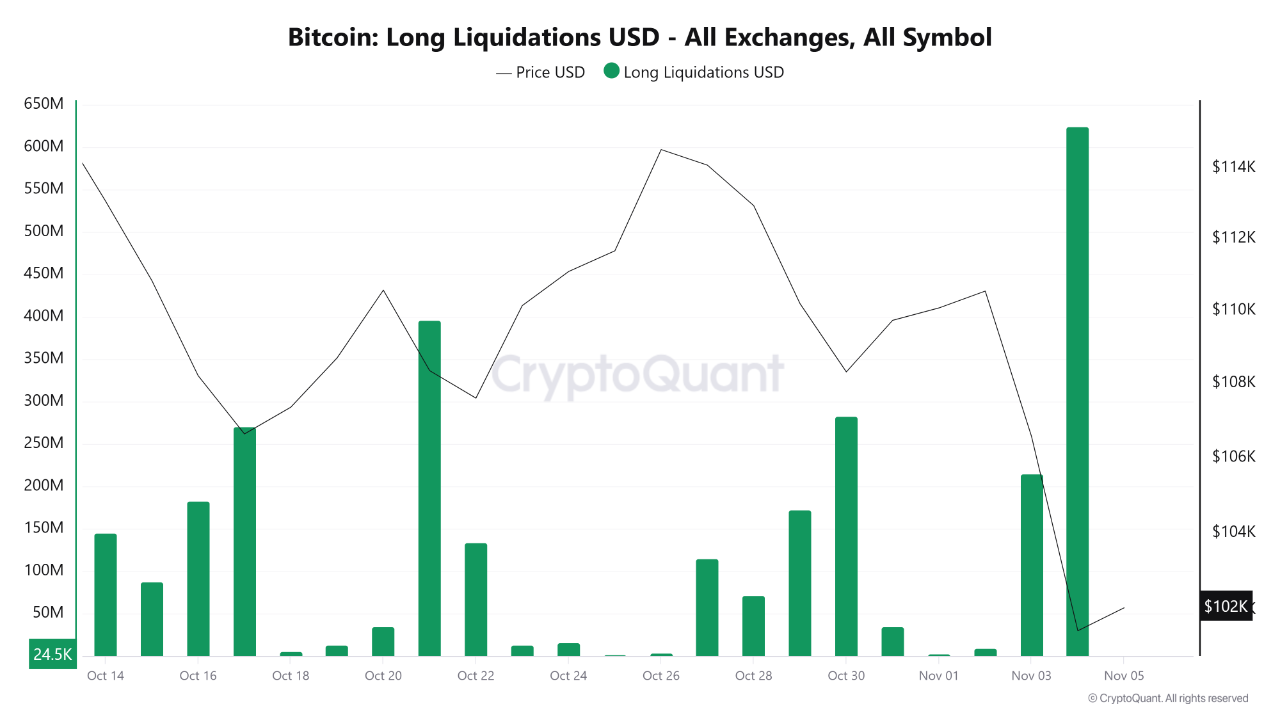

Yesterday, BTC dropped to a five-month low of below $100,000, spurred by US equity correction and profit-taking whales. Bitcoin reached an intraday low of $98,900 before rebounding to reclaim $101,000.

Bears Defeat $107,000 Stronghold

Notably, amid the current price action, Bitcoin lost the $107,000 support level after 130 days of consolidation, according to a Crypto Onchain report on CryptoQuant. The market leader ranged between the support and $123,000 from late June but breached the support with its drop below the psychological $100,000 level on Tuesday.

The correction sparked a rampage, particularly on long positions, chalking off over $640 million over the past 24 hours. Notably, the liquidation frenzy was the second largest since June 2021, with the October 10 bloodbath at the helm of history.

However, Bitcoin has shown resilience, recovering to $101,000 yesterday and further rallying to $102,730 at the time of writing. Meanwhile, Crypto Onchain identified a key detail about the $101,000 support, one that would determine its subsequent price action.

The Last Line of Defense for Bitcoin Bulls

Specifically, the analysis highlighted that bulls stepped in at $98,000 and pushed Bitcoin to its most critical level for bulls. This level aligns with the lower support trendline of an ascending channel in the daily timeframe.

The report noted that the $101,000 support line is more than a psychological line; it is the trendline that has determined Bitcoin’s market structure since October 2023.

Meanwhile, Crypto Onchain noted that defending the channel’s bottom would be decisive in Bitcoin’s near-term price trajectory. Defending the $101,000 support would spark a rebound, making the current dip a buy opportunity.

However, if Bitcoin does not hold this level and bearish momentum persists, it would defy its market structure, putting the bull run in jeopardy. This would mark steeper corrections to new lows for the largest cryptocurrency by market cap.

Could Bitcoin Hit $92,000?

Nonetheless, another analysis shows that there is a nearby CME gap that Bitcoin might fill. The futures market chart shows a gap between $92,000 and $93,000, which is 10% away from the current market price.

Bitcoin has historically tended to fill these CME gaps before its next rally, and market observers are not ruling out the possibility. However, strong support around the current level could prevent this move and force BTC northwards.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc