A new report from State Street shows that institutional investors are steadily increasing their exposure to Bitcoin and other crypto assets.

Specifically, the report found that 50% of the surveyed firms plan to raise their crypto allocations over the next 12 months, while another third intend to keep their positions unchanged.

Meanwhile, nearly seven in ten institutions expect to boost their holdings within five years, and a quarter of them plan major increases. Notably, this trend shows how crypto assets are becoming more acceptable in global investment strategies.

Asset Managers and Owners Increasing Exposure to Crypto

The report notes that crypto assets currently make up 7% of institutional portfolios, but the number could more than double to 16% within three years.

Interestingly, asset managers are leading the trend, taking bigger positions than asset owners. Specifically, 14% of managers hold between 2% and 5% of their portfolios in Bitcoin, compared to 7% of owners.

Managers are also three times more likely to invest 5% or more of their assets in Ethereum. Moreover, 6% of managers hold at least 5% in smaller cryptocurrencies, meme coins, or NFTs, compared to just 1% of owners.

Further, tokenized assets are gaining ground. Per the report, asset managers have higher exposure to tokenized public and private assets, coming in at 6% and 5% respectively, while owners sit at 1% and 2%.

Managers also hold more digital cash at 7%, compared to 2% for owners. Meanwhile, despite expressing caution, more than half of all respondents expect between 10% and 24% of all investments to be made through digital or tokenized assets by 2030.

Bitcoin and Crypto Delivering Impressive Returns

According to State Street, the respondents are seeing impressive returns from crypto assets. Expectedly, Bitcoin delivers the highest gains for 27% of respondents, and a quarter expect it to stay on top for the next three years.

Notably, Ethereum follows closely, with 21% saying it’s currently their best performer and 22% expecting it to remain so. However, tokenized public and private assets deliver smaller returns, about 13% and 10%, but still play an important role in diversified portfolios.

In addition, institutions also believe mainstream adoption is approaching. For instance, 68% expect digital investments to become standard within ten years, more than double last year’s 29%.

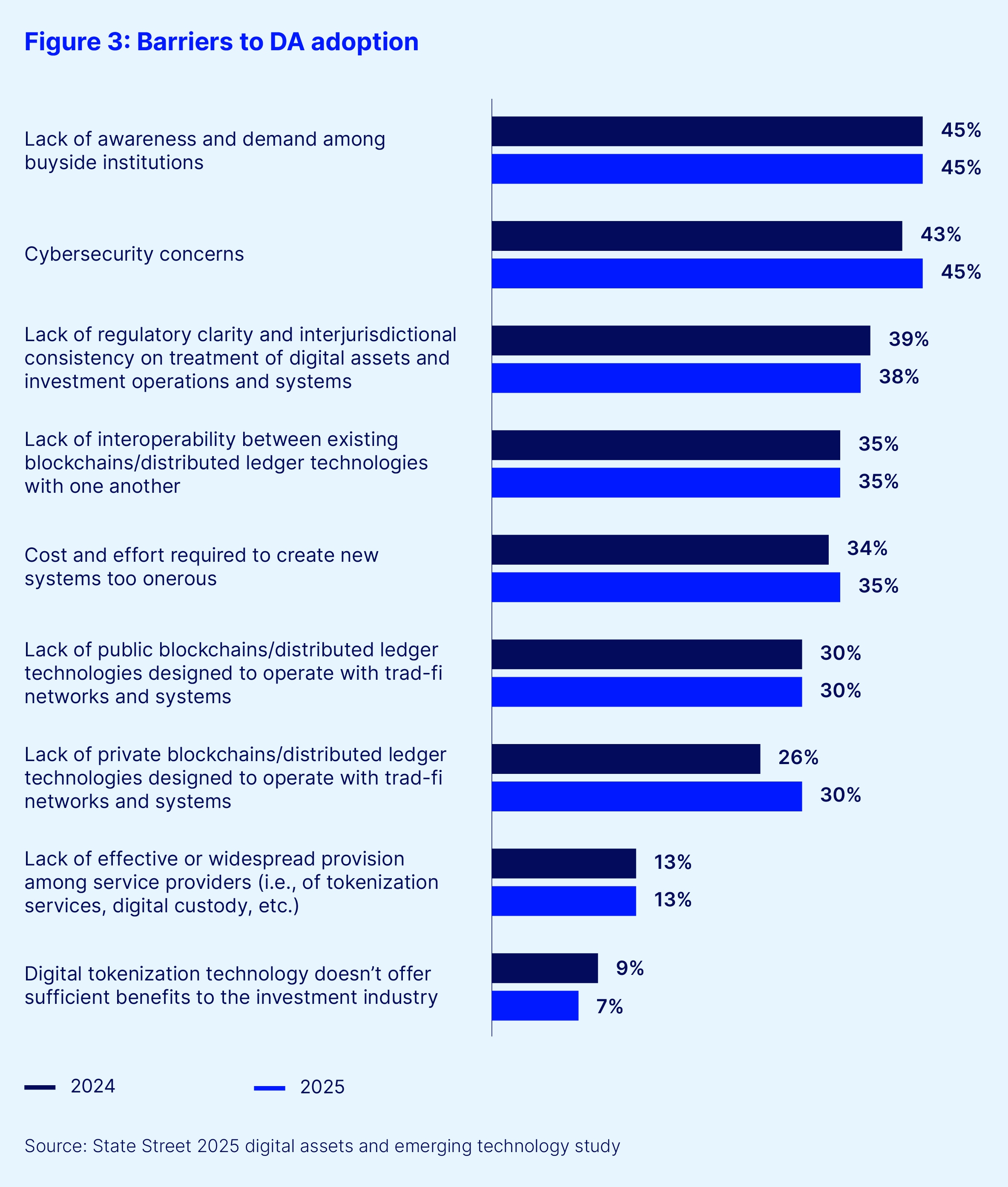

While most respondents cited challenges around cybersecurity, regulation, and education, they see crypto assets as long-term growth drivers. Respondents expect investment returns to improve by up to a third and anticipate cost savings between 23% and 37% as they include blockchain, automation, and AI into their operations.

Global Surge in Institutional and Retail Crypto Adoption

Interestingly, these institutional trends align with external data showing accelerating crypto adoption worldwide. For one, a September 2025 report from Chainalysis found that assets in tokenized funds jumped from $2 billion in August 2024 to over $7 billion a year later.

In the United States, institutional confidence remains strong amid favorable policies. A June 2025 study from Coinlaw.io reported that 80% of U.S. institutional investors planned to increase crypto exposure in 2024, while partnerships between banks and crypto firms have grown by 52% since 2022.

Chainalysis also revealed that North America handled $2.3 trillion in crypto transaction value between July 2024 and June 2025, with 26% of global activity coming from institutional trades such as ETF flows and portfolio rebalancing.

Importantly, retail investors are showing the same momentum. A January 2025 research article from Security.org found that 28% of U.S. adults now own crypto, up from 27% the previous year.

Crypto.com’s February 2025 report estimated that global crypto ownership reached 659 million by the end of 2024, a 13% jump from the year before. JPMorgan Chase Institute data through May 2025 showed that 17% of active checking account holders moved funds into crypto accounts, up two percentage points from early 2024.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  TRON

TRON