In its most aggressive year of Bitcoin accumulation to date, Strategy has significantly expanded its holdings, according to recent statistics published by on-chain analytics provider CryptoQuant.

Per CryptoQuant, the firm’s 12th Bitcoin acquisition of 2025 brought in 13,390 BTC at an approximate cost of $1.34 billion.

Since late 2024, Strategy (formerly MicroStrategy) has added Bitcoin across nearly all price points, ranging from below $70,000 to just under $110,000 per coin. This trend shows a consistent investment pattern that remained unfazed by price fluctuations over the course of several months.

Sharp Capital Deployment During Price Rallies

Strategy’s largest single purchases occurred during high volatility phases. Specifically, the company added approximately 55,500 BTC, followed closely by another 51,780 BTC, both during rapid price surges.

These large-scale transactions coincided with a rally in Bitcoin’s market price, which hovered close to its all-time highs of nearly $110,000 late 2024. During this period, Strategy invested a record $5.43 billion—its largest deployment to date.

CryptoQuant data shows that this activity marks the beginning of the firm’s most concentrated buying phase, stretching from late 2024 into early 2025.

Meanwhile, cumulative investment across all Strategy purchases has reached $39.41 billion by May 2025. Despite smaller investments throughout, including a low of $6 million, the sustained capital injection has steadily driven up the average cost basis.

As of now, the firm’s realized price per Bitcoin stands at $69,287. This figure, represented by the red line on CryptoQuant’s chart, shows the total dollar cost divided by the number of BTC held.

Current Holdings Show 50% Unrealized Gains

As Bitcoin trades above $100,000 in May 2025, Strategy’s holdings are valued at approximately $59.24 billion. This represents an unrealized gain of nearly $19.83 billion. The MVRV ratio, which compares market value to realized value, confirms that the company currently sits on a 50% paper profit across its entire position.

According to CryptoQuant, the realized price rose significantly during late 2024 and early 2025, especially as Strategy announced successive acquisitions.

Notably, the firm’s announcement of a $42 billion investment initiative in early 2025 aligned with a notable spike in Bitcoin’s market price, pushing it above $100,000. This mirrors the price action during Strategy’s first-ever investment announcement, which preceded a price increase to around $60,000. Each announcement visibly impacted market trends.

Growing Share of Bitcoin Supply and Portfolio Metrics

By May 2025, Strategy controls roughly 2.864% of Bitcoin’s total circulating supply of 19.86 million.

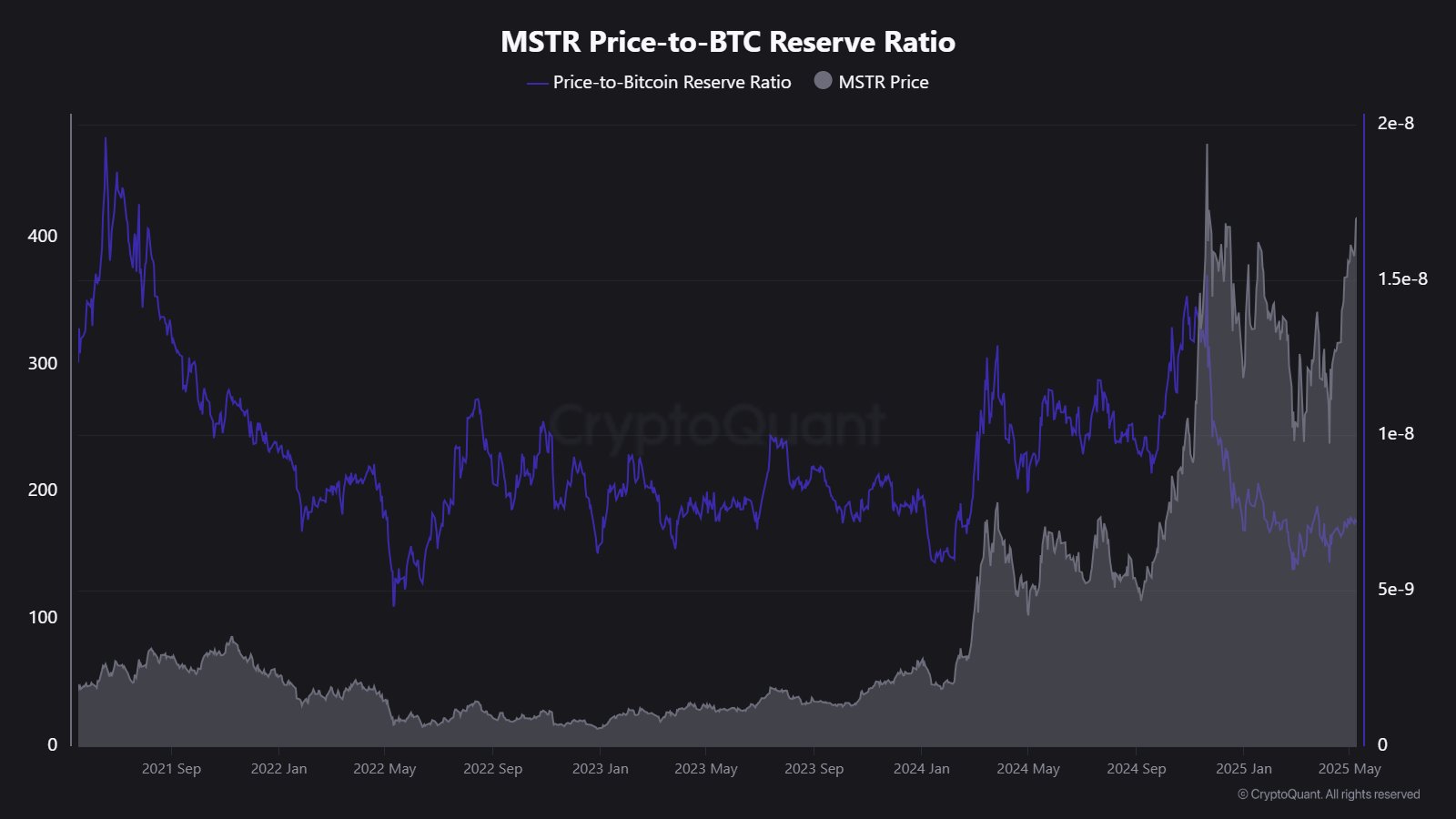

This significant holding places the firm among the largest corporate holders of BTC globally. CryptoQuant’s data further shows that the firm’s current price-to-BTC ratio stands at 7.27. This metric indicates the firm’s market value relative to its Bitcoin assets.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc