Bitcoin (BTC) is nearing a potential trendline breakout, with the possibility of surging to $95K, while long-term targets extend to $110K.

Bitcoin has surpassed $87,000, marking a bullish start to the week. In the past 24 hours, the leading cryptocurrency has surged by nearly 4%.

This bullish recovery has moved past the 200-day EMA line and is testing a long-standing resistance trendline. Will this short-term recovery result in a breakout rally that pushes Bitcoin to the $95,000 level?

Bitcoin Price Analysis Signals Potential Breakout Rally Ahead

In the daily chart, the BTC price trend showcases a V-shaped reversal gaining momentum. The recovery run, starting from the recent downswing low at the $76,600 mark, has accounted for a recovery of nearly 14%.

As per the Fibonacci levels, the recovery run has reclaimed the 61.80% Fibonacci level at $86,146. Currently, Bitcoin trades at a market of $87,182, marking its second consecutive bullish candle.

Amid the positive trend, the daily RSI line showcases a surge in bullish momentum as it resurfaces above the halfway line. Additionally, the short-term recovery is hinting at a positive crossover between the recently converged 20-day and 200-day EMA lines.

However, the medium-term trend remains negative due to the negative crossover between the 50-day and 100-day EMA lines.

Arthur Hayes Predicts Bitcoin to Hit $110K

Amid the ongoing recovery, Arthur Hayes, co-founder of BitMEX, predicts that Bitcoin will reach $110,000 before retesting crucial support at $76,500. Hayes anticipates this bullish rally, fueled by a shift in the Federal Reserve’s stance from quantitative tightening (QT) to quantitative easing (QE) for U.S. Treasuries.

He disregards the ongoing tariff wars, calling them “transitory inflation” in the global markets.

I bet $BTC hits $110k before it retests $76.5k.

Y? The Fed is going from QT to QE for treasuries. And tariffs don’t matter cause “transitory inflation”. JAYPOW told me so.

I’ll expound on that in my next essay, that’s the TLDR for your TikTok peanut brain.

— Arthur Hayes (@CryptoHayes) March 24, 2025

Metaplanet Adds More BTC

MetaPlanet, the Japanese counterpart of Strategy (formerly MicroStrategy), has recently added $12.6 million worth of Bitcoin to its holdings. This move follows the appointment of Eric Trump to its advisory board.

MetaPlanet now holds 3,350 BTC, worth $291.3 million. With institutional support and favorable macroeconomic conditions for Bitcoin, the uptrend is likely to continue gaining momentum.

*Metaplanet Acquires Additional 150 $BTC, Now Holds 3,350 BTC* pic.twitter.com/sakdkwHSQZ

— Metaplanet Inc. (@Metaplanet_JP) March 24, 2025

Market Takes a Holding Stance

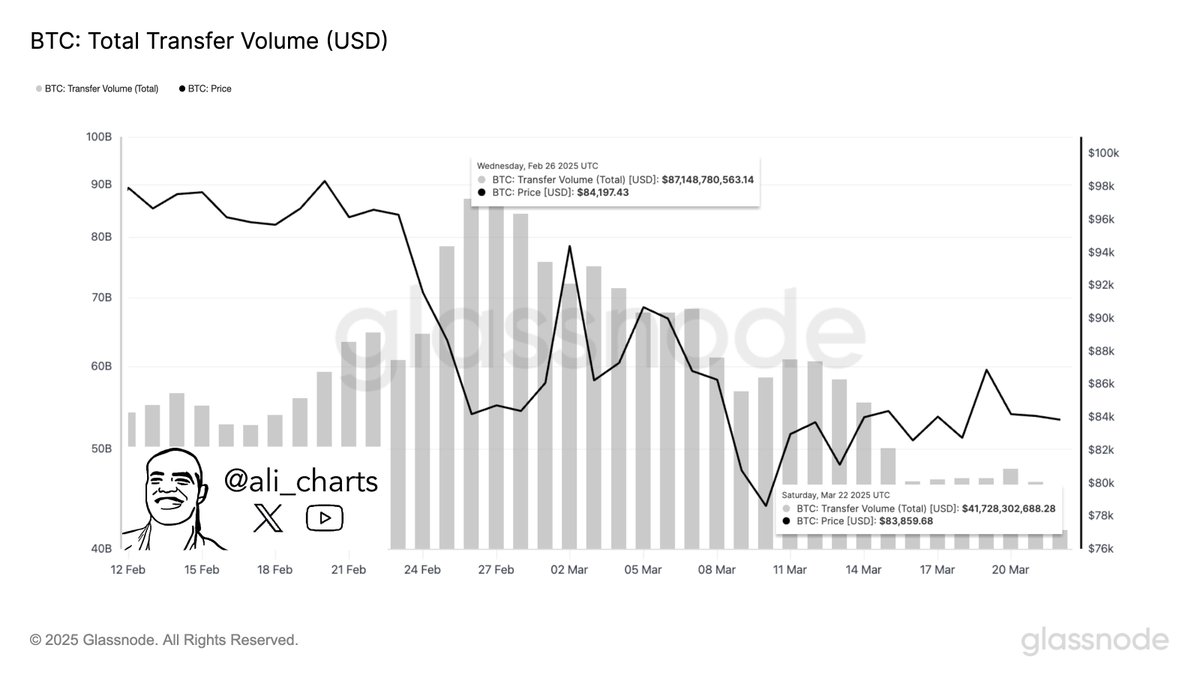

On the network side, crypto analyst Ali Martinez has pointed out a significant shift in Bitcoin’s transfer volume. Over the past month, the total transfer volume has nearly halved, dropping from $87 billion to $42 billion.

This substantial decline in transfer volume suggests that market sentiment has shifted towards a holding stance.

Bitcoin Price Targets Extend to $95K in the Short-Term

The immediate price target for Bitcoin is the 78.6% Fibonacci level, close to the $95,000 mark, which represents an upside potential of around 10%. On the downside, crucial support levels are at the $85,000 mark and near the 200-day EMA line.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON