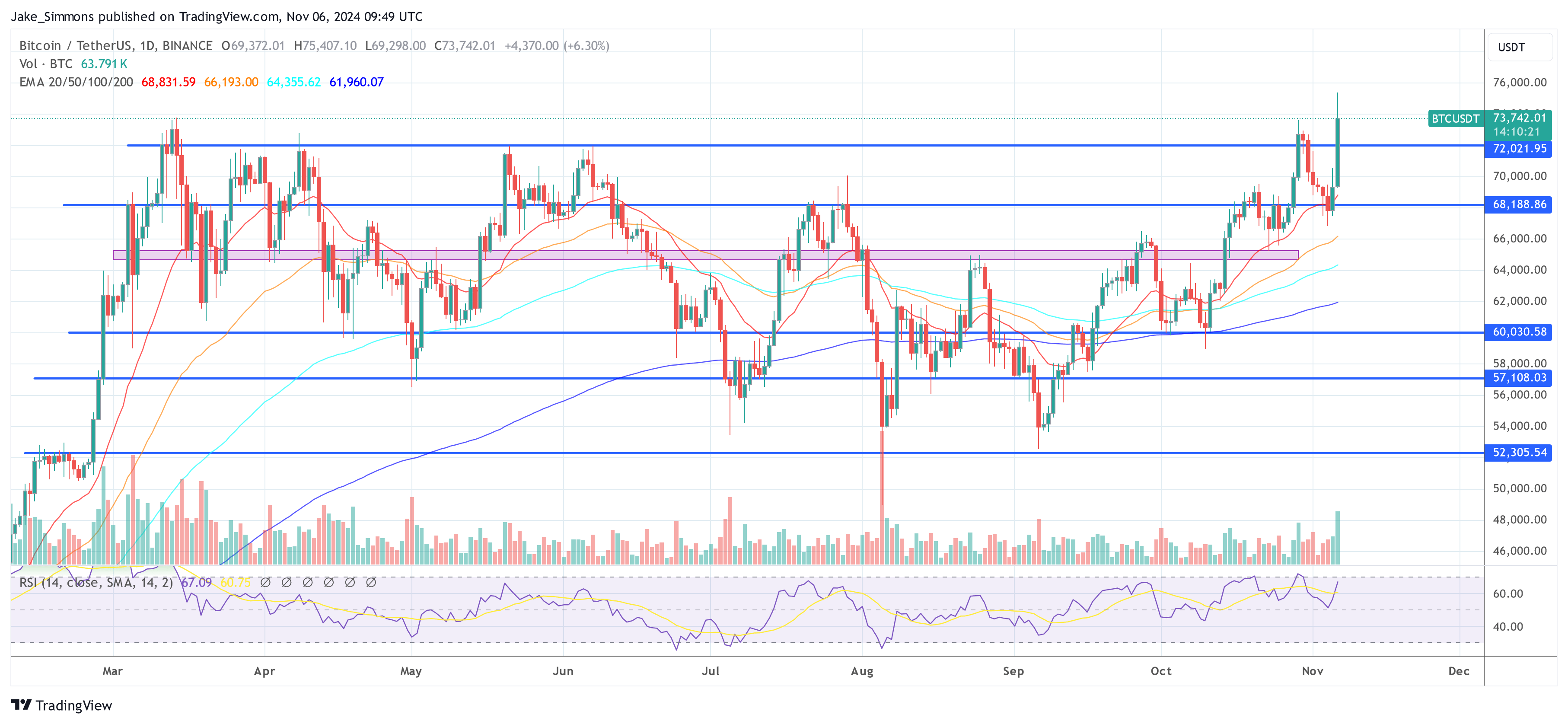

The 2024 US presidential election is decided. Donald Trump will get a second term, defeating Kamala Harris. In the midst of election night, the Bitcoin price rose to a new all-time high of $75,407 on Binance.

The euphoria is driven by Trump’s big election promises. He wants to establish Bitcoin as a national strategic stockpile, fire Securities and Exchange Commission (SEC) Chairman Gary Gensler and generally enforce a crypto-friendly policy. While a Harris victory would have meant a short-term setback for Bitcoin according to most experts, the predictions by the majority of experts are extremely bullish thanks to the Trump victory.

However, renowned economist Henrik Zeberg offers a cautionary perspective. Zeberg warns that Trump’s proposed economic policies could precipitate a US recession, leading to a “blow-off top” scenario for Bitcoin and the broader crypto market. Central to his argument is Trump’s plan to replace certain taxes with tariffs to stimulate domestic economic growth.

Is A Bitcoin Blow-Off Top Scenario Looming?

Drawing parallels with historical events, Zeberg suggests that Trump’s tariff strategy could echo the economic missteps of the 1920s and 1930s. In a post on X, he shared a link to the Wikipedia page for the Smoot-Hawley Tariff Act of 1930. He stated: “Now everything is lined up for history to repeat itself. US Tariffs implemented into a Recession—reinforcing the downturn and popping the Greatest Bubble ever.”

Related Reading

The Smoot-Hawley Tariff Act is widely regarded as a catalyst that deepened the Great Depression. By substantially increasing US tariffs on imported goods, the act prompted retaliatory tariffs from other nations, leading to a severe contraction in international trade. This protectionist spiral exacerbated global economic decline, resulting in heightened unemployment and prolonged hardship worldwide.

Amid these economic concerns, Zeberg has projected a significant, yet potentially short-lived, surge in Bitcoin’s price. “Making it Simple! BTC target 115-123K,” he asserted via X a few days ago. His analysis is grounded in Fibonacci extension levels—a technical analysis tool used to predict future price movements based on historical price patterns.

Related Reading

According to Zeberg’s analysis, the critical level to monitor is the 1.618 Fibonacci extension, calculated at $114,916.16. He suggests that this level is “very likely the top,” indicating that Bitcoin could reach this price point before experiencing a significant reversal.

The analysis also notes other key Fibonacci levels that may serve as resistance points during Bitcoin’s ascent. The 0.382 level at $77,437.88 marks a significant initial resistance following the breakout from the previous all-time high.

The 0.618 level at $85,205.47 could act as minor resistance as the price climbs. Additionally, the 1.0 level at $107,435.71 represents a crucial psychological and technical threshold, while the 1.27 level at $123,148.19 indicates a possible overshoot beyond the primary target zone.

An annotation on Zeberg’s chart poses the question, “58% in less than 3 months into the top?” This suggests he anticipates a rapid price increase within a relatively short time frame, consistent with historical patterns.

At press time, BTC traded at $73,742.

Featured image created with DALL.E, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc