The mid-point of the London Blockchain Conference’s opening day was dominated by an announcement from nChain’s Chief Science Officer, Owen Vaughan.

His session focused on why blockchain technology is a critical component of Web3 and the barriers that must be overcome to get there. Chief among these is the reality that as the benefits of distributed ledger technology (DLT) become more widely appreciated, many competing DLT offerings are entering the market. It can hardly be said that a glut of independent, non-interoperable databases does anything to help provide better information for business on any meaningful scale.

Vaughan starts by canvassing the history of blockchain in the public sphere.

“In the beginning, the world was dark. Because there was no blockchain. But in 2008, Bitcoin came along. A zero-to-one technology. Before Bitcoin, we really had nothing that could do what a blockchain could do. After Bitcoin, we had everything we needed. A decentralized digital money system with a fixed monetary supply. We have programmable money. A publicly available permissionless database to store everything you need.

Shortly after that, Vaughan refers to the emergence of things such as Litecoin and Ripple – but under the hood, they’re similar in terms of how the transactions work.

Then, fast-forward further, and we see an exponential increase in these altcoins: Ethereum, with its smart contract capability; Cardano, one of the first proof-of-stake (PoS) blockchains; and the rise of dedicated privacy coins like ZCash.

Now, in 2024, there’s too many blockchains. Over 1,000 blockchains. What do we do about that?

Vaughan illustrates this with a story. He got married a couple of months ago—in Argentina. The emblem of the city of Buenos Aires flashes up on the screen alongside cute wedding pictures.

Argentina, however, has economic problems. It’s a difficult place to do business. They have hyperinflation. In the month Vaughan got married, there was 11% inflation. As a result, the country has currency controls, and banks in the United Kingdom refuse to send money to the country.

Nonetheless, looking to get hitched in Argentina as he was, Vaughan and his bride-to-be had vendors to pay. Living and working in the U.K., Vaughan discovered that many of their vendors accepted crypto, in particular, dollar-backed stablecoins like USDC.

Vaughan used digital assets to pay these, which worked great until one of the vendors claimed they had not received payment for their services. After looking into it, Vaughan discovered that he had accidentally used a derivative asset of the stablecoin, meaning the assets went to an address the vendor didn’t use. It wasn’t a disaster, Vaughan explains: he relied on the vendor’s goodwill to allow him to take the steps necessary to recover the funds, which cost in excess fees and lost time.

This status quo, Vaughan says, is fundamentally in conflict with the promise of Web3. Web3, Vaughan defines, is a ‘decentralized online ecosystem based on blockchain.’

Whilst we don’t have a rigorous definition of Web3, Vaughan realized that when we talk about Web3 we are signaling a set of values we believe in: Security, data ownership, direct exchange of value.

“These are very human-centric concepts and that’s something I think we can all believe in when we’re trying to build Web3. But the key point is that it relies on blockchain,” he said.

That’s where the problem of 10,000 blockchains comes into play. The current way of managing interoperability between chains is by using bridges. If you have one blockchain, and want to move your asset to another blockchain, you have to move your asset to the bridge, then off the bridge to the new blockchain. In essence, this attempts to solve the problem of having two blockchains by introducing a third blockchain. This is not a solution, says Vaughan. It involves locking, swapping, and burning your assets.

“Any system that relies on a third party burning my asset? There’s something fundamentally wrong with that.”

Swapping, burning, locking—what these words really mean is complexity, explains Vaughan. They are high cost and very painful to integrate. They only work between blockchain pairs. According to Vaughan, the biggest hacks in “crypto” history have occurred on bridges.

Vaughan likes the word ‘transfer’. He doesn’t want assets to have the same value on each chain in order to swap. He wants to send an asset to a receiver on another blockchain.

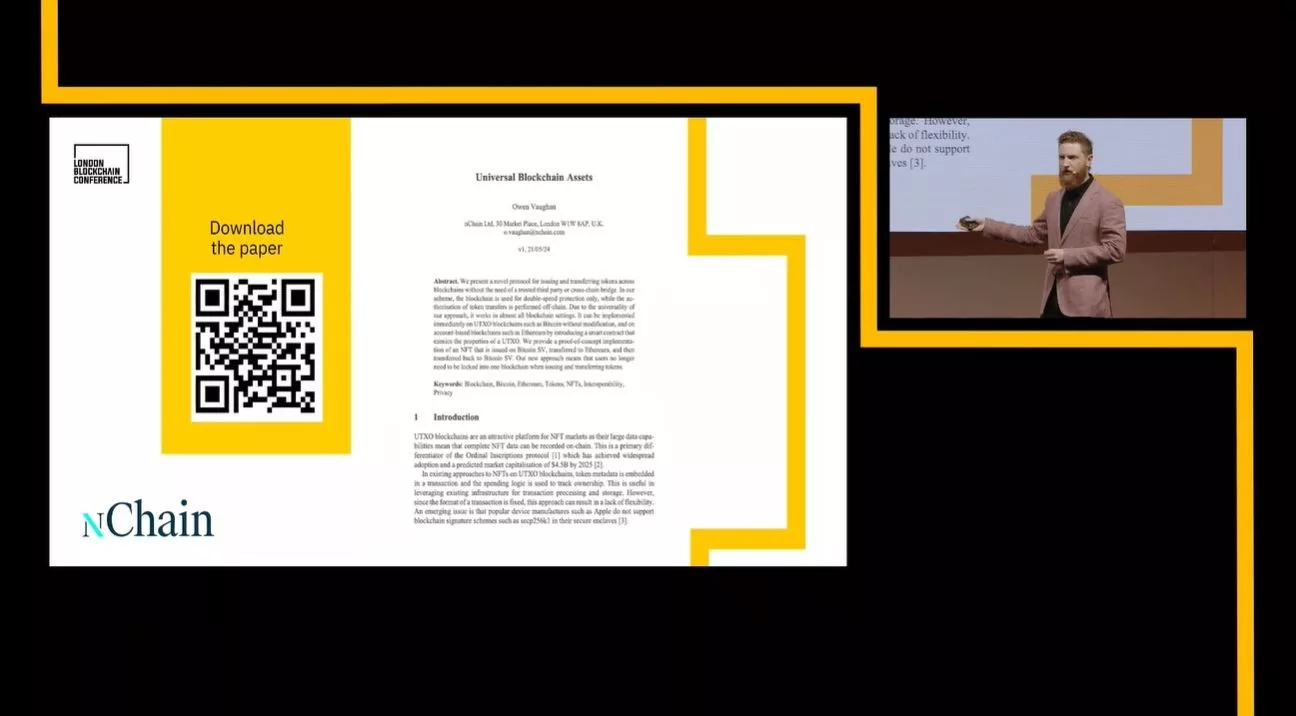

Enter the grand solution developed by Vaughan at nChain, which has the potential to radically change the way assets are transferred between chains. It’s called the “UNIVERSAL BLOCKCHAIN ASSET,” a token that can be issued on one blockchain that isn’t restricted to that blockchain.

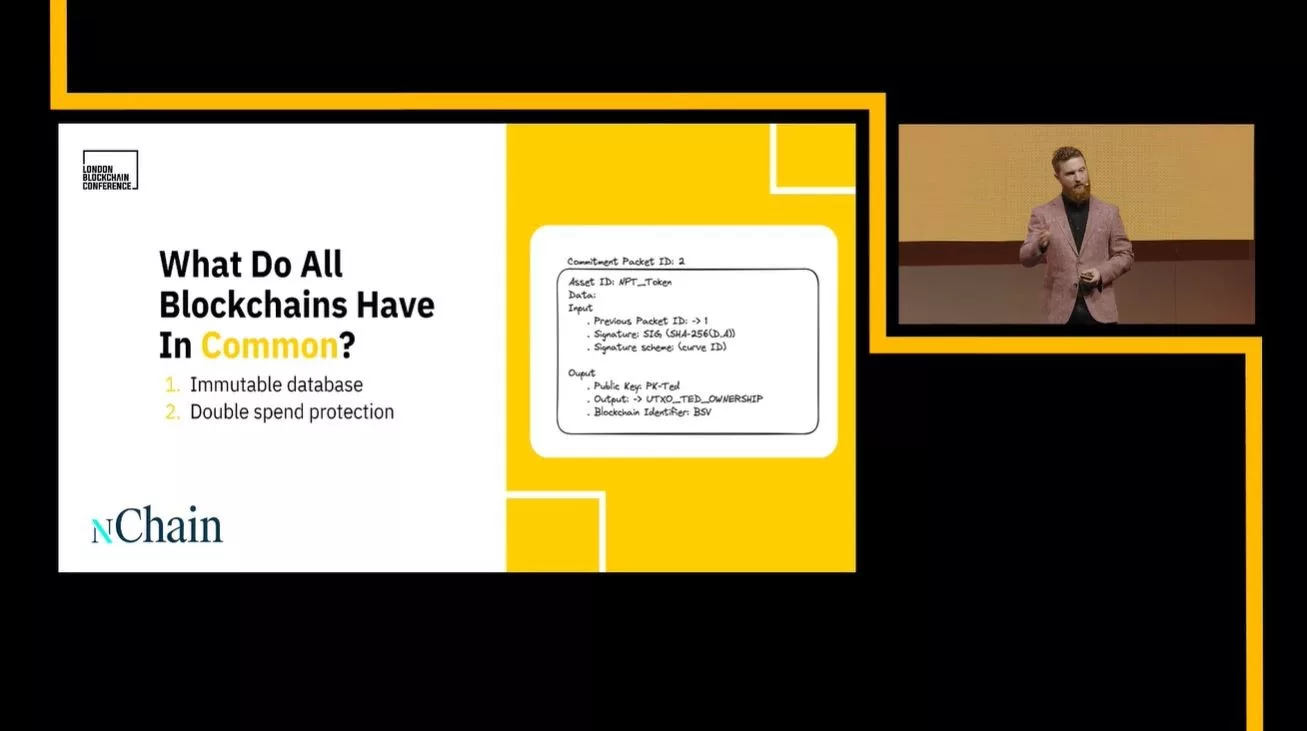

How was this achieved? Vaughan explains that they started by considering the properties common to all blockchains. The first is that they are immutable databases. The second is some form of double-spending protection.

Using these two properties, nChain has introduced a new medium of transfer: a packet. It’s not a blockchain transaction; it’s a packet that records a transfer of ownership. This packet has inputs and outputs: inputs are references to the previous owner/packet and a signature from the previous owner authorizing the transfer. In the outputs is the recipient’s public key and, crucially, a reference to an unspent blockchain output and the chain it lives on.

The fact that the recipient has a nominated, unspent output that can’t be changed means that when the recipient transfers their token onward, they confirm that transfer by creating a transaction spending that output and updating the token to its final state. (That’s where the double spend protection comes from)

“It’s remarkably simple,” beams Vaughan.

“The simplest ideas are the hardest. The ones that were staring at you in the face all along. It’s also why I know it works. I know it’s secure. As long as you understand how this protocol uses blockchain outputs, you’ve understood everything,” he added.

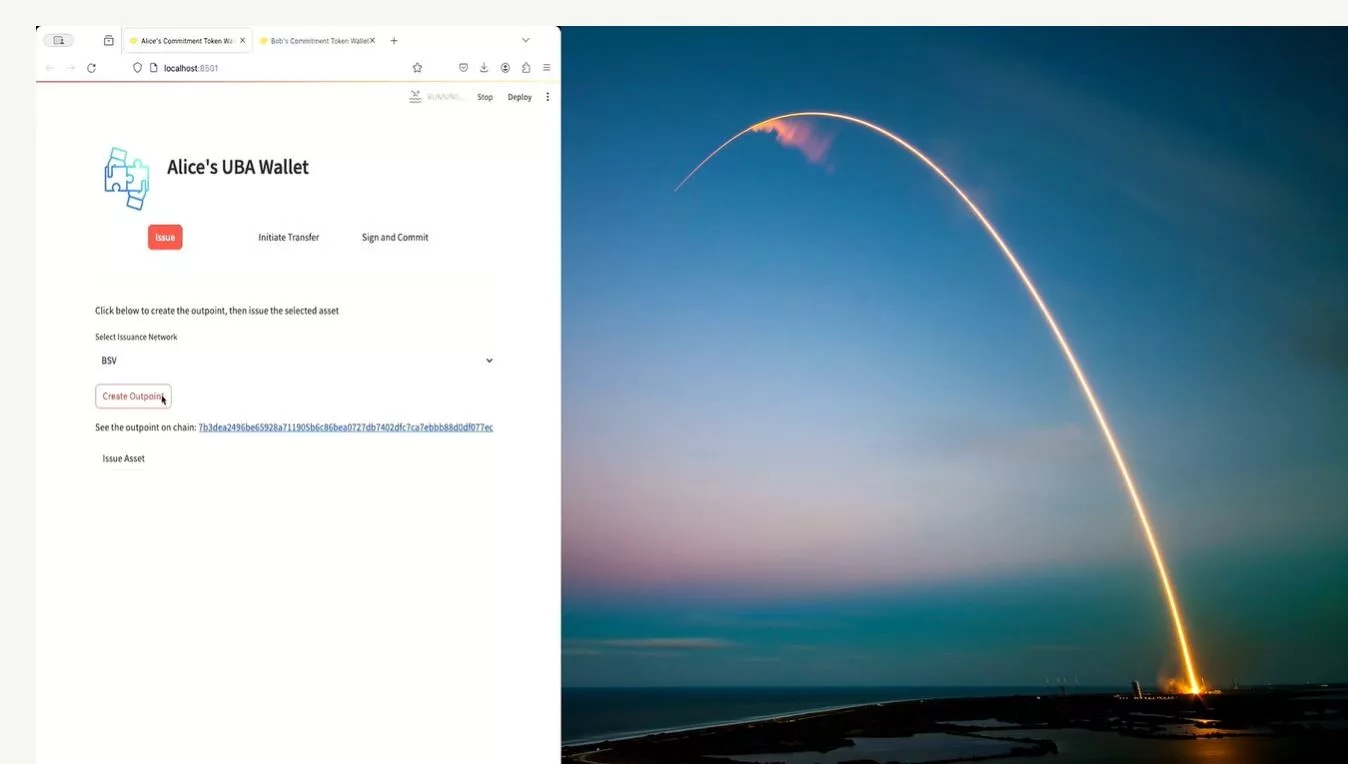

Vaughan gives a live demonstration of a working implementation of what he’s describing. He shows a non-fungible token (NFT) issued to Alice: she specifies that this is an issue on BSV, and then the issuer can assign her as the owner of the NFT. Alice wants to send this to Bob, who uses Ethereum. He creates an outpoint on Ethereum, which doesn’t naturally have outpoints, but we can code a simple, smart contract that mimics the properties of an outpoint. Then, he has everything he needs to receive the NFT.

So what if your blockchain is different from mine? Now, it doesn’t matter. You can transfer tokens across the chain just as easily as if you’d transferred them on the same chain. It’s a great solution and certainly one that would have helped Vaughan pay for his Argentinian wedding.

Watch: Showcasing power of blockchain tech with nChain Web3 event app

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano