Evergrande Group, the major real estate company in China, was likely to default on its debts, and thus BTC fell from $48,500 to $39,600. The asset was recovering from this phenomenon hitting $45,000 level and Twitter tipping in BTC surely helped. The announcement of Evergrande paying back the debt and the Fed monetary policy remaining the same also assisted in the comeback. However, BTC fell to $40,700 in an hour due to an old news article circulating online of China’s ban explaining that all cryptocurrencies activity is criminalized except possession. This month we had some good news too for BTC, El Salvador started building an infrastructure which would facilitate the BTC as legal tender. UAE is leading the crypto wonder with trading in Dubai free zones approved by the regulators and even Ukraine adopted laws which will make movement and usage of cryptocurrency easier.

Technical Outlook: Bitcoin

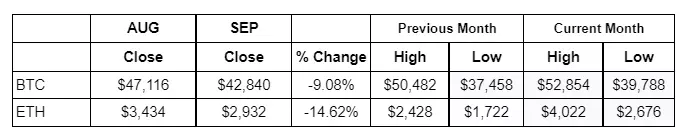

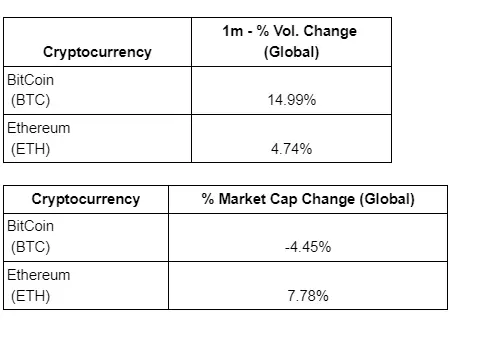

BTC started the month with bulls power and ended with bear attack. Technically, on a weekly time frame the asset has made a ‘Bearish Engulfing’ pattern at the high of ~$59,500 and witnessed a sharp correction almost by 25% making the low of $39,600. BTC is trying to take support at the crucial support zone from $40,000 to $37,500, (last time it gave an upside breakout from these levels) and the longer lower shadow indicates buying as well. If the prices hold and sustains above these levels then we can expect some relief rally.

Ethereum, the leading altcoin, had an amazing rally in the first week of September and touched the 4k mark. But it was soon followed by market correction and the asset fell by 25%. Then it continued to fluctuate between $3,000 to $3,500. It followed BTC and fell sharply due to Evergrande news. But it incurred heavier losses and made a low of $2,656 from $4,000 levels. With Bitcoin bull accumulating at $43,000, Ethereum also started to recover until yesterday’s China stricter announcement pushed it back into a bearish zone. This month brought some good news for the asset too where the data showed Ethereum layer-two scaling protocols have had a great adoption with the gas price increasing again, and is processing more transactions daily as compared to BTC network.

Golem Network introduced an app which will allow the users to mine Ethereum on their personal laptops, but the profit can only be reaped at a much later stage. The Ethereum futures are trading at a premium, investors are shifting from Bitcoin based products. SEC of Thailand issued a license to an Eth-based real estate project where the firm would be using Eth’s blockchain technology to enable traders to invest even little amounts such as $150 in costly real estate projects. By the end of October Ethereum Optimism would have upgraded its protocol allowing developers to deploy networks with just one click. AMC entertainment have announced that they would be accepting movie ticket payments by the end of 2022 not only as Bitcoin but Ethereum and litecoin are also added.

ETH, post making a high of $4,027 made a ‘Dark Cloud Cover’ (Bearish pattern) on a weekly time frame and corrected almost by 34% making a low of $2656. Since then the asset has been trading in ‘Lower Top Lower Bottom’ formation. ETH has a very strong support at $2,602 (61.8% Fibonacci Retracement Level). If the prices hold and sustains above the support level then we could expect the bulls to resume the up move. If it breaks the support then the asset could further slide to $2,400 levels.

Others

Other leading altcoins have in general been quite volatile through this month. The start of September saw major altcoin witness good inflows from the institutional as well as retail investors. The first 10 days of September saw several altcoins trading in the green, some even witnessing rallies upward of 20%. However, post that a reversal set in the widespread crypto market took a hit due to several fundamental developments mentioned above. As of today both bears and bulls are fighting to take control of these assets which is why most altcoins are trading in a range bound fashion. However at current levels the altcoins landscape does seem attractive which is reflected in higher volumes seen across multiple coins over the past couple of days. It would be safe to say that generally altcoins have a lagging response to BTC & ETH but eventually end up following the trend set up by these leading assets.

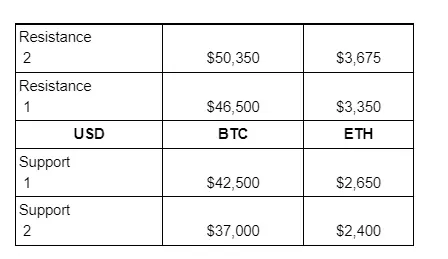

Key Levels:

(The author, Nirmal Ranga is the Chief Revenue Officer for ZebPay. The views are his own)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin